Should I Buy a Home Now or Wait?

Should I Buy a Home Now or Wait?

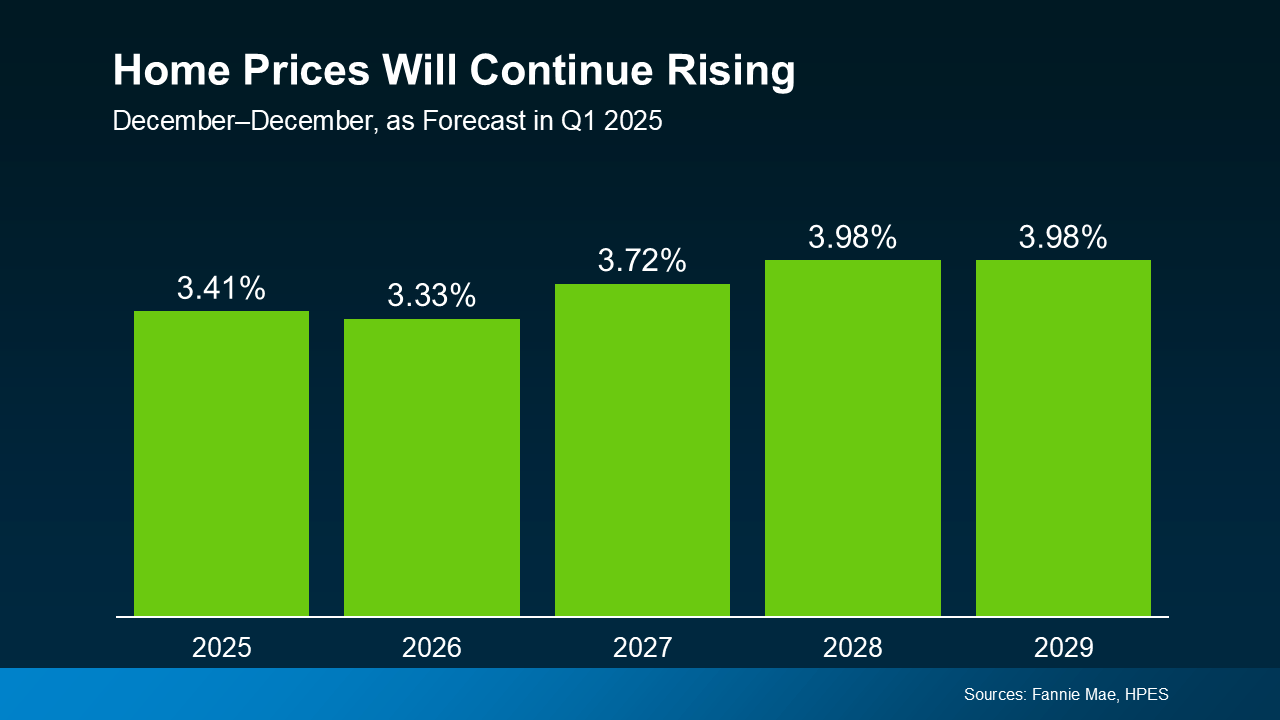

Over time, this kind of consistent price growth means the longer you wait, the more you could pay for a home down the line.

Even if mortgage rates come down slightly, rising prices could offset any potential savings. And if both home prices and rates go up? That could significantly increase your monthly payment and overall cost.

The Bottom Line

Trying to time the market is a gamble – and it’s one that often doesn’t pay off. The best strategy is to buy when you're financially ready and able. That way, you start building equity and long-term wealth sooner.

If you’ve been waiting to make a move, let’s connect and talk through your options. The best time to buy might be now – before prices climb even more.

Even in markets where price growth is slower or where small short-term declines occur, homeownership remains a strong long-term investment.

Here’s what to remember:

-

Home prices next year are expected to be higher than they are now. The longer you delay, the more you could end up paying.

-

Holding out for lower mortgage rates or a price drop could backfire. Even if rates fall slightly, rising home prices may still make buying later more costly.

-

Buying sooner allows you to start building equity right away. Over time, that equity grows and strengthens your financial position.

What You Could Miss Out On

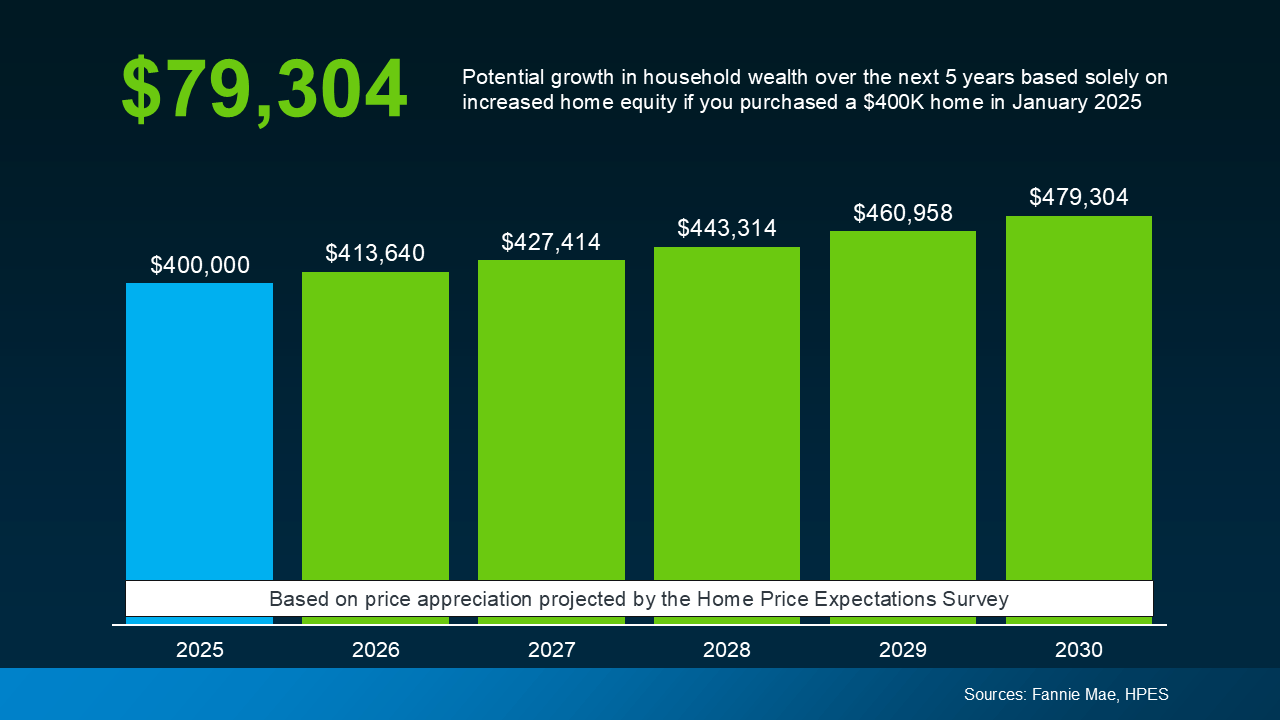

To put this into perspective: according to expert forecasts, if you purchased a $400,000 home in 2025, it could appreciate by nearly $80,000 by 2030 (see graph below):

That kind of equity growth can give your future wealth a serious boost — and it’s exactly why so many homeowners are glad they got in when they did. The time you spend in the market matters.

So instead of asking, “Should I wait?” the better question is, “Can I afford to buy now?” Because if you can stretch a bit or are open to buying a smaller place to start, here’s why it’s worth it:

Today’s market has its challenges, but there are ways to navigate them — from exploring different neighborhoods to looking into down payment assistance or talking to your lender about alternative financing options.

The key is making a move when it’s right for you — not holding out for a perfect scenario that might never come.

Bottom Line

Time in the market beats timing the market.

If you’re wondering whether to buy now or wait, remember: real estate favors those who step in — not those who try to predict the perfect moment.

Want to see what home prices are doing in our area? Whether you’re ready to buy or just weighing your options, let’s make a plan that sets you up for success.

Categories

Recent Posts

GET MORE INFORMATION