What’s Your House Worth Now? The Answer May Surprise You

What’s Your House Worth Now? The Answer May Surprise You

Let’s talk about something you might not check as often as your bank account — your home’s value. But when it comes to your finances, it’s something you shouldn’t overlook. When was the last time you had a professional walk you through your home’s current market value?

For many people, their home is the biggest financial asset they own. And if you’ve been living in yours for several years, chances are it’s been growing your wealth quietly behind the scenes. You might even be surprised by how much.

What Is Home Equity?

That hidden wealth is called home equity — the difference between your home’s current market value and what you still owe on your mortgage. It increases as home prices rise and as you make monthly payments toward your loan. Here’s a quick example to make it clear:

If your home is now worth $500,000 and you still owe $200,000, that means you’ve built up $300,000 in equity. And right now, many homeowners are sitting on more equity than they realize.

According to Cotality (formerly CoreLogic), the average mortgage holder has about $311,000 in home equity.

Why Your Equity May Be Higher Than You Expect

There are two major reasons so many homeowners are seeing record levels of equity today:

-

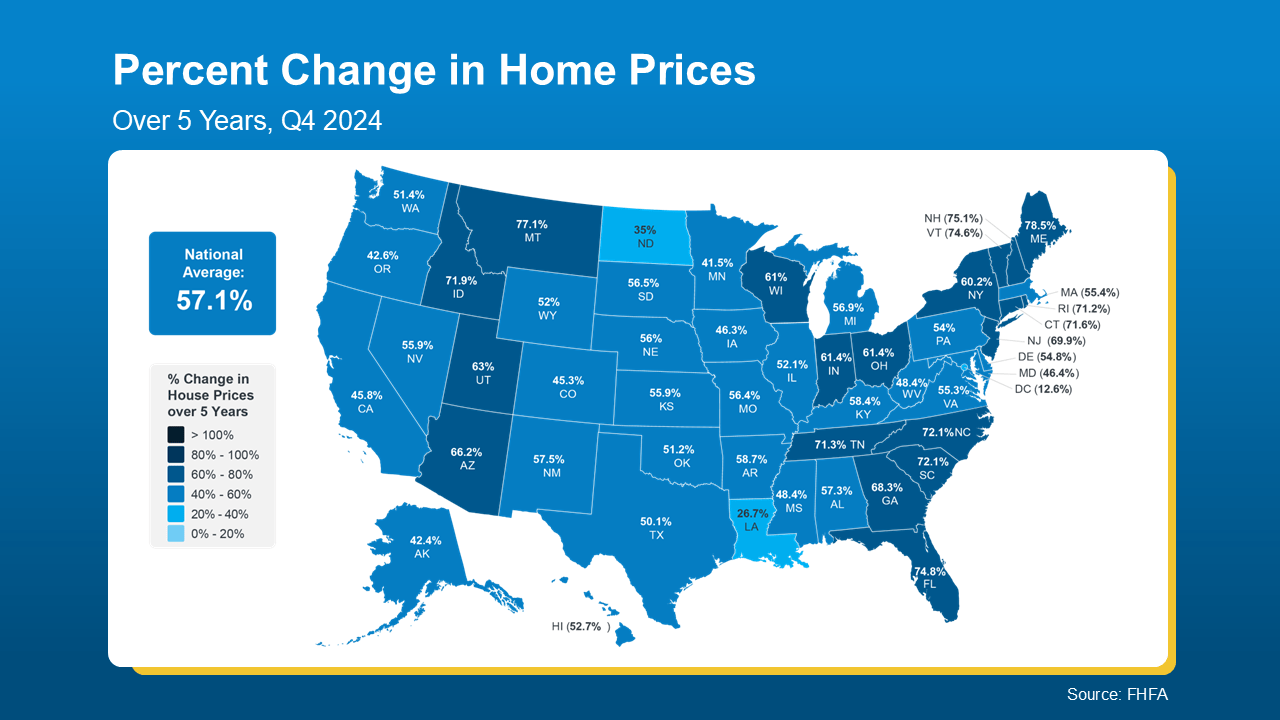

Major Home Price Increases – Per the Federal Housing Finance Agency (FHFA), home prices have risen more than 57% nationwide in just the past five years (see map below):

And if you bought your home several years ago (or earlier), chances are it's worth significantly more today due to the steady rise in home prices over time.

-

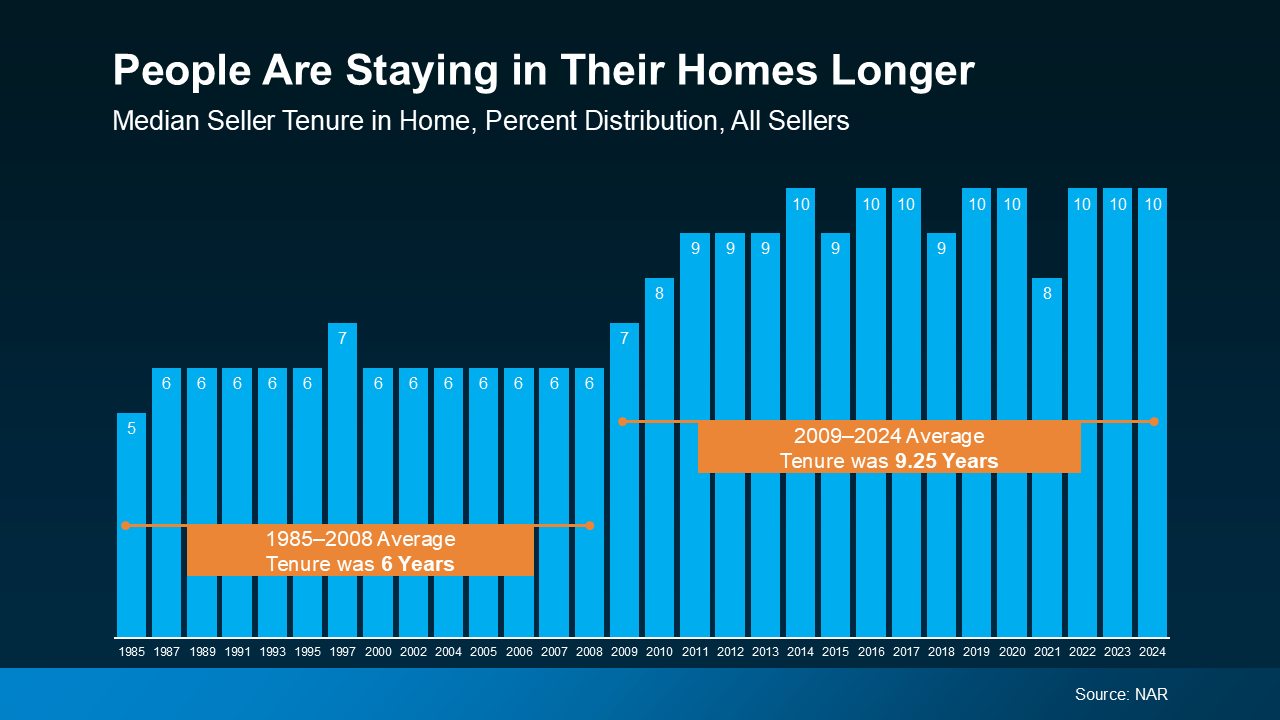

Homeowners Are Staying Put Longer – According to data from the National Association of Realtors (NAR), the typical homeowner now remains in their home for around 10 years (see graph below):

That’s a lot longer than it used to be. And over those 10 years? You’ve built equity simply by paying down your mortgage and benefiting from increasing home values.

If you’re one of those long-time homeowners, here’s just how much that appreciation has worked in your favor. According to NAR:

“Over the past decade, the typical homeowner has accumulated $201,600 in wealth solely from price appreciation.”

What Can You Do with That Equity?

Your home is likely your largest financial asset – and when used wisely, your equity can help you unlock some exciting possibilities:

-

Buy your next home. You can use your equity toward the down payment on your next place – and in some cases, you may even be able to buy your next home with all cash.

-

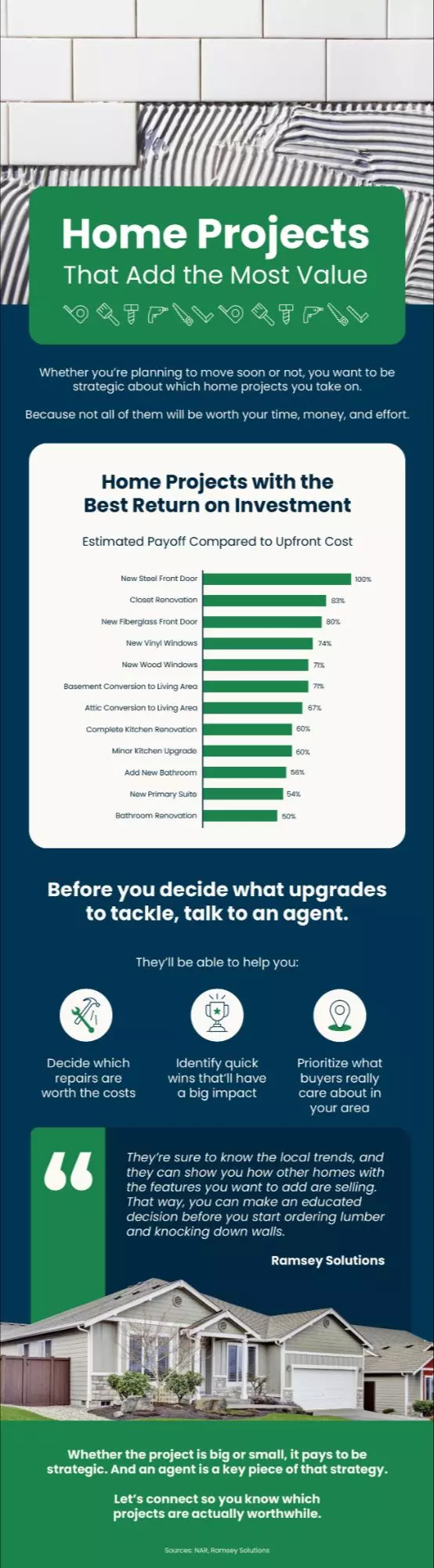

Renovate your current home. Upgrade your space to better fit your current lifestyle – and if you choose the right improvements, you could even boost your home’s value in the process.

-

Invest in your future. Your equity might be the key to launching that business you’ve been dreaming about, giving you a jumpstart on new income opportunities.

Bottom Line

Your home might be worth far more than you think. Whether you’re planning to sell, upgrade, or just want to understand your financial options, your equity is more than a number – it’s a powerful resource.

If you sold your home and tapped into that equity, what would your next move be? Let’s talk through your goals and map out the possibilities.

Categories

Recent Posts

GET MORE INFORMATION