What You Can Do When Mortgage Rates Are a Moving Target

What You Can Do When Mortgage Rates Are a Moving Target

Have you noticed what’s been happening with mortgage rates lately? One day, they dip slightly—then the next, they climb right back up. If you’re trying to figure out whether now’s the right time to buy, it can definitely feel a little overwhelming.

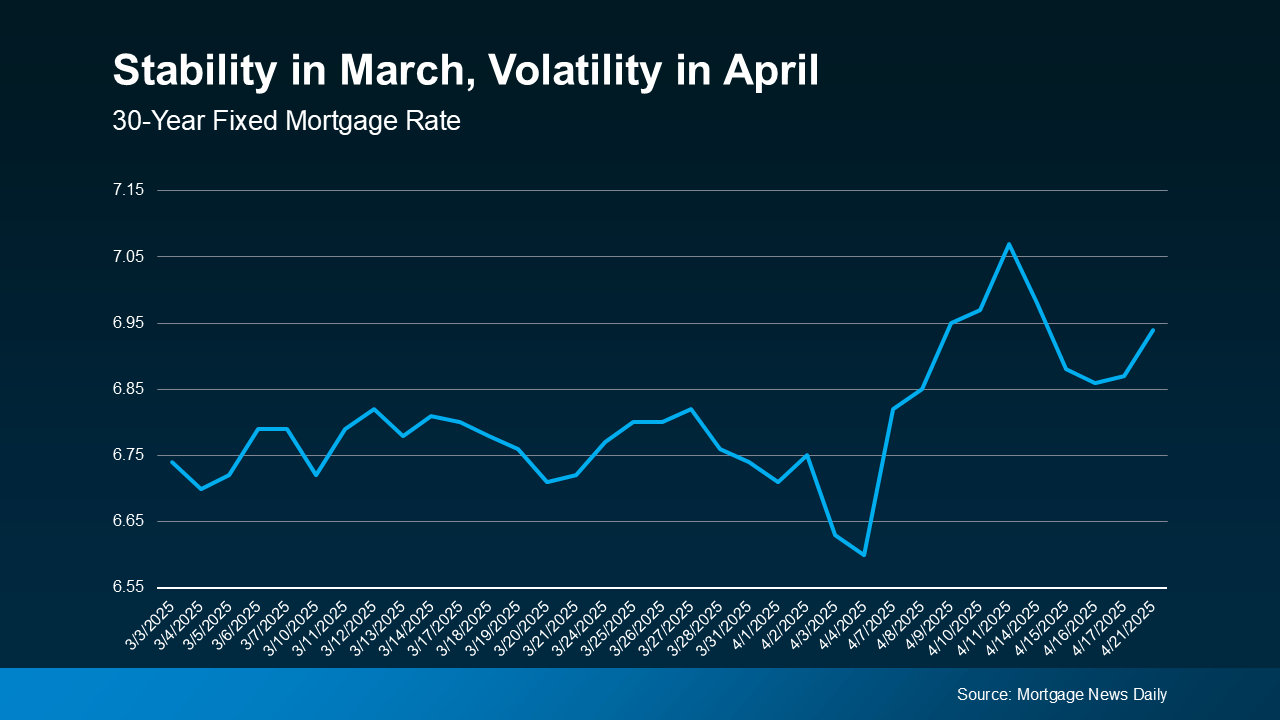

The graph below shows this pattern clearly. Using data from Mortgage News Daily, you can see that while March was relatively steady, April has brought more fluctuations—a bit of a roller coaster when it comes to rates:

Mortgage rate fluctuations lately are a normal response to economic shifts.

That’s why trying to perfectly time the market isn’t the best approach. While you can’t control where rates go, you can take steps to strengthen your position. Despite today’s uncertainty, there are a few things you can focus on.

✅ Your Credit Score

Your credit score has a major impact on the mortgage rate you’re offered. Even small improvements can reduce your monthly payment. As Bankrate puts it:

“Your credit score is one of the most important factors lenders consider when you apply for a mortgage. Not just to qualify for the loan itself, but for the conditions: Typically, the higher your score, the lower the interest rates and better terms you’ll qualify for.”

If you’re unsure of your score or how to raise it, reach out to a reliable loan officer for help.

✅ Your Loan Type

There are different kinds of mortgage loans available, each with its own eligibility criteria and potential rate differences. The Consumer Financial Protection Bureau (CFPB) notes:

“There are several broad categories of mortgage loans, such as conventional, FHA, USDA, and VA loans… Rates can be significantly different depending on what loan type you choose.”

Speaking with multiple lenders can help you compare loan types and understand what suits you best.

✅ Your Loan Term

Loan length also plays a role in your interest rate and the total interest you’ll pay. As Freddie Mac explains:

“When choosing the right home loan for you, it’s important to consider the loan term… Your loan term will affect your interest rate, monthly payment, and the total amount of interest you will pay over the life of the loan.”

Common options include 15-, 20-, or 30-year terms. A lender can guide you on the best fit for your plans.

Bottom Line

You may not be able to predict what happens with mortgage rates, but you can focus on what you can control. Let’s talk about how to get prepared so you’re ready when the time is right to buy.

Categories

Recent Posts

GET MORE INFORMATION