Why Today’s Foreclosure Numbers Aren’t a Warning Sign

Why Today’s Foreclosure Numbers Aren’t a Warning Sign

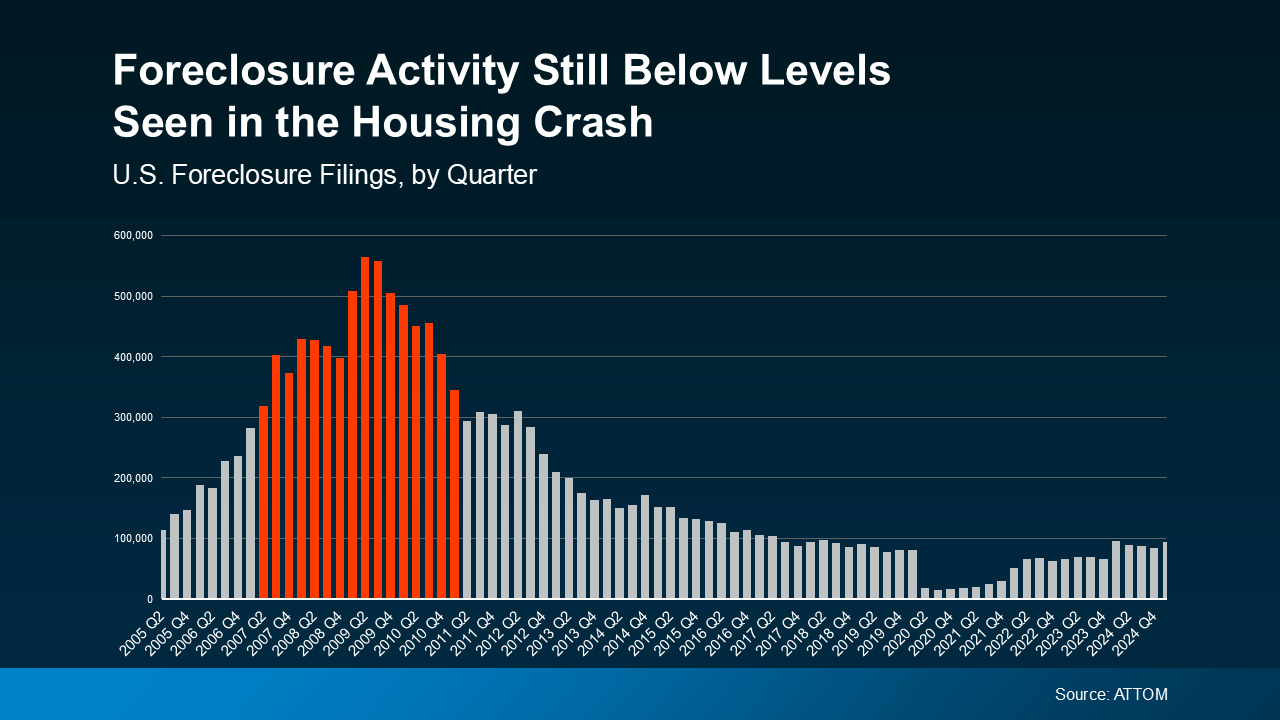

With inflation driving up the cost of many essentials, it’s understandable to wonder how that impacts the housing market. Some worry rising costs might push more homeowners into default, leading to a surge in foreclosures. And with recent reports showing an uptick in filings, those fears are gaining traction. But context is everything — and there’s no need to panic.

This Isn’t 2008 All Over Again

Yes, foreclosure filings did rise slightly in ATTOM’s latest quarterly data. But they’re still lower than typical historical levels — and far below the extreme numbers we saw during the 2008 crash. A look at the data over time makes the difference clear.

When you compare Q1 2025 (on the right side of the graph) to the peak during and after the housing crisis in 2008 (highlighted in red), it’s obvious: today’s market is in a much healthier position.

Back in 2008, risky lending practices left many homeowners stuck with loans they couldn’t afford. That triggered a wave of foreclosures, oversupplied the market with distressed properties, and sent home prices tumbling.

Today’s lending standards are far more secure, and most homeowners are in a stronger financial position — that’s why foreclosure activity remains low.

It’s also important to understand the context. The numbers from 2020 and 2021 were extremely low due to a nationwide moratorium designed to help homeowners during uncertain times. Comparing today’s data to those years can be misleading. When you look instead at more typical years like 2017–2019, current foreclosure filings are still down and nowhere near crash-level highs.

Of course, any foreclosure is tough for the people going through it — and that shouldn’t be overlooked. But on a broader scale, the market isn’t in distress.

Why a Surge in Foreclosures Isn’t Likely

One key reason we aren’t seeing a spike is homeowner equity. Thanks to rising home prices over recent years, many homeowners have built up substantial equity — and that gives them a cushion. As Rob Barber, CEO of ATTOM, puts it:

“While levels remain below historical averages, the quarterly growth suggests that some homeowners may be starting to feel the pressure of ongoing economic challenges. However, strong home equity positions in many markets continue to help buffer against a more significant spike.”

So, if someone faces financial challenges, they might be able to sell their home — rather than going through foreclosure. That’s a big difference from 2008, when many homeowners owed more than their homes were worth.

Rick Sharga, Founder and CEO of CJ Patrick Company, adds:

“. . . a significant factor contributing to today’s comparatively low levels of foreclosure activity is that homeowners—including those in foreclosure—possess an unprecedented amount of home equity.”

Bottom Line

Even though foreclosure numbers have ticked up, they’re still well below historic norms — and nowhere near the levels seen during the last crash. Plus, today’s homeowners are in a much stronger position financially.

If you're facing difficulties with your mortgage, it's always best to reach out to your lender to explore your options. There may be solutions available before foreclosure becomes necessary.

Categories

Recent Posts