Why Would I Move with a 3% Mortgage Rate?

Why Would I Move with a 3% Mortgage Rate?

If you’ve got a 3% mortgage rate, it’s understandable to be reluctant to let that go. Even if moving has crossed your mind, you might keep thinking, “why would I give that up?”

But that question could be causing you to overlook what you really need. In most cases, people don’t move because of their mortgage rate—they move because their life situation changes. So instead, consider this:

What are the chances you’ll still be living in your current home five years from now?

Take a moment to reflect on your future. What do the next few years look like? Are you planning to expand your family? Do you have kids who are about to leave home? Is retirement approaching? Are you feeling like you’ve outgrown your current space?

If everything is staying the same and you’re happy where you are, staying could be the right move. But if there’s even a small chance that a change is coming—even if it’s not immediate—it’s worth evaluating your plans now.

That’s because a year or two can significantly impact what your next home may cost.

What the Experts Say About Home Prices over the Next 5 Years

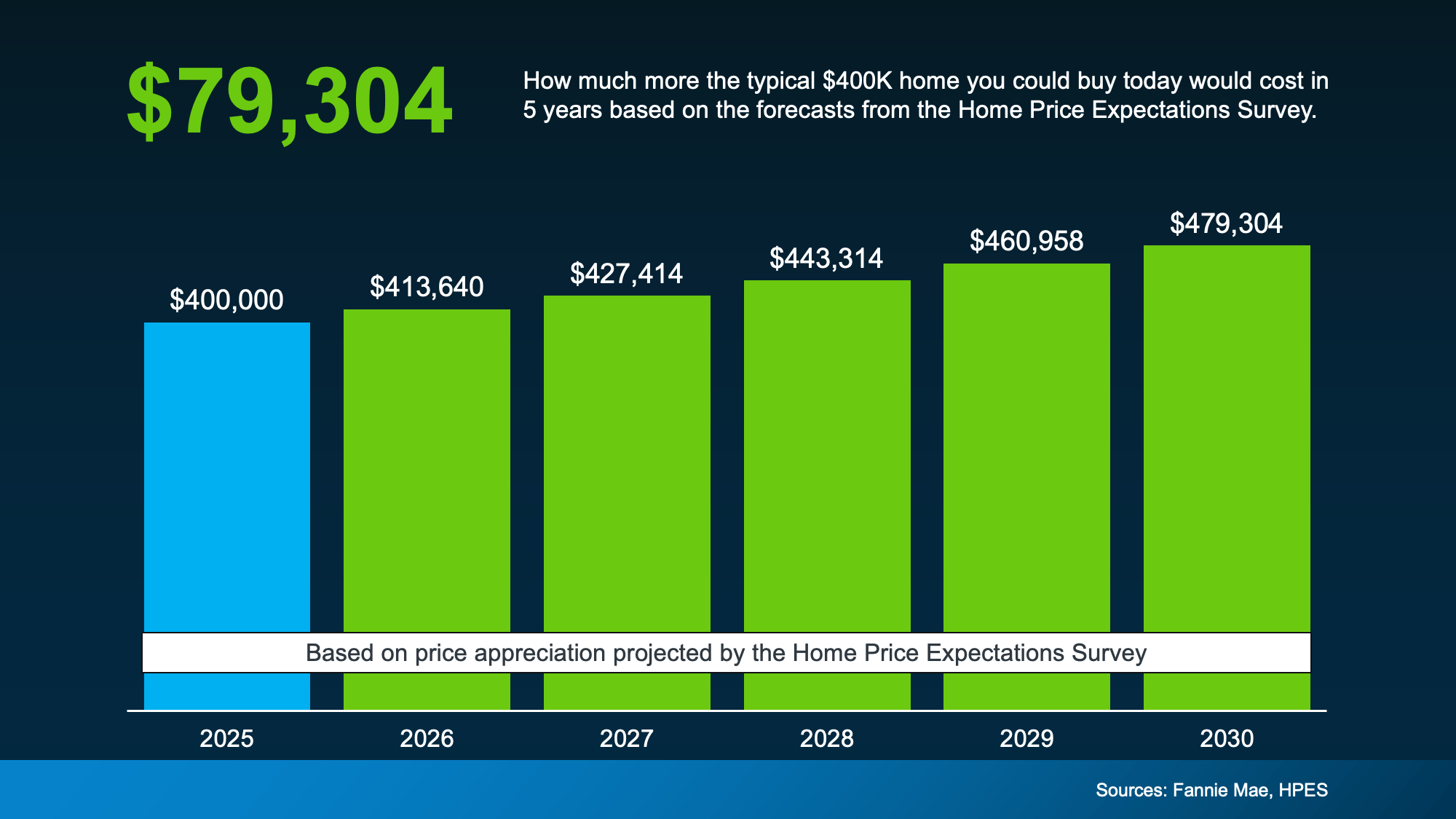

Every quarter, Fannie Mae surveys more than 100 housing experts about where they believe home prices are headed. The general agreement? Prices are projected to keep increasing through at least 2029 (see graph below):

Even though these forecasts don’t suggest huge annual jumps, they still point to consistent growth. Sure, some areas might experience slower price increases, flat trends, or small short-term declines. But over time, prices generally go up. And over the next five years, even modest increases can add up quickly.

For instance, if you’re planning to purchase a home around the \$400,000 mark, waiting five years to make that move could mean spending nearly \$80,000 more, based on current expert projections (see graph below):

In other words, the more you delay, the more expensive that future home may become.

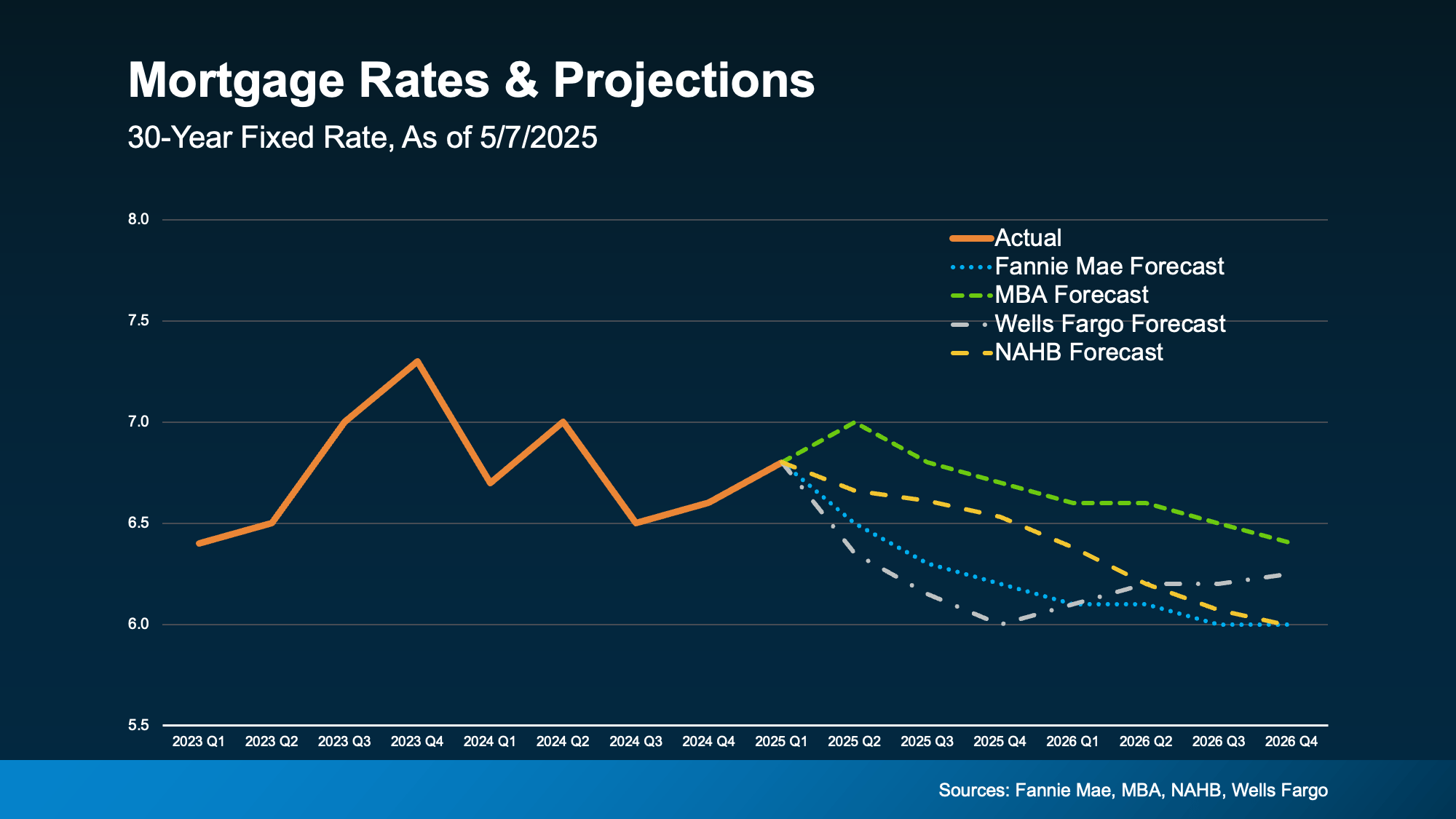

If you’re fairly certain a move is on the horizon, now might be a good time to evaluate your plans. You don’t need to relocate right away, but it could be beneficial to discuss your options before home prices rise even more. While mortgage rates are projected to decline, the drop isn’t expected to be drastic. And if you’re waiting for 3% rates to come back, industry experts agree that’s unlikely to happen (see graph below):

So, instead of asking: “why would I move?” the better question might be: “when should I move?” – because once you break down the numbers, postponing your plans might not actually save you money. That’s exactly the kind of discussion you should be having with a knowledgeable agent right now.

Bottom Line

Holding onto a low mortgage rate can be wise – but not if it starts limiting your options.

If a move is even slightly on the horizon for you, it’s a good idea to evaluate the numbers now and start preparing.

Are there other price ranges you'd like to explore? Let’s talk, and I’ll help walk you through the figures so you can make a well-informed decision about your next steps.

Categories

Recent Posts