What’s Next for Home Prices and Mortgage Rates?

What’s Next for Home Prices and Mortgage Rates?

If you're considering making a move this year, two housing market factors are likely on your mind: home prices and mortgage rates. You're probably wondering what will happen next and whether it's better to move now or wait it out.

The best approach is to make an informed decision based on the latest available information. Here’s what experts are saying about both prices and rates.

1. What’s Next for Home Prices?

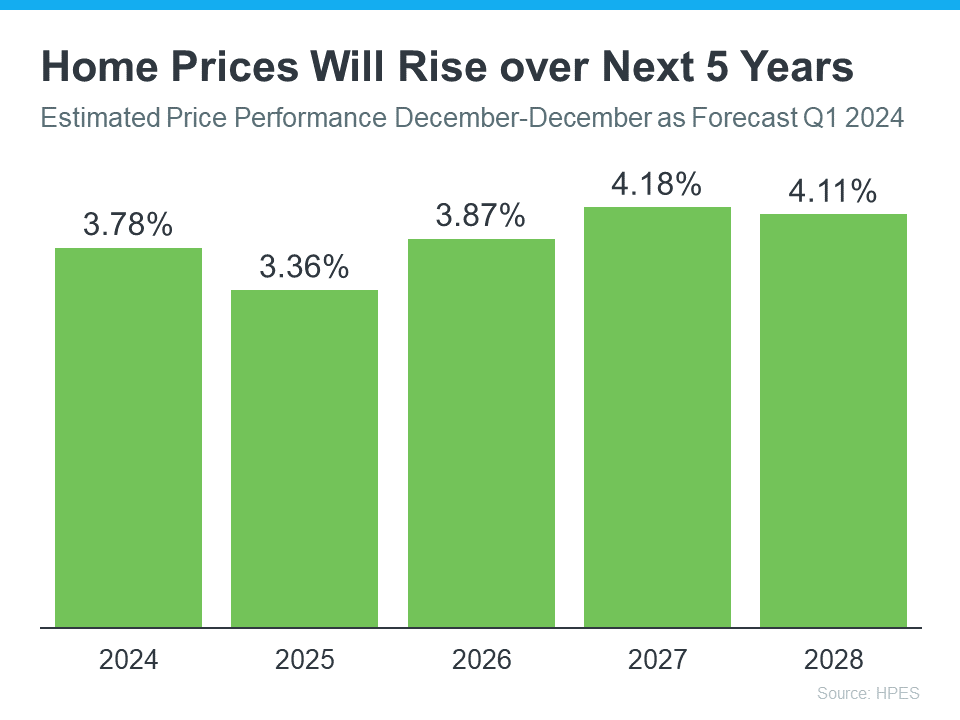

One reliable source for home price forecasts is the Home Price Expectations Survey from Fannie Mae, which gathers insights from over one hundred economists, real estate experts, and investment and market strategists.

According to the latest survey, experts project that home prices will continue to rise at least through 2028 (see the graph below):

While the rate of appreciation varies year-to-year, this survey indicates that home prices will continue to rise (not fall) for at least the next five years, and at a more normal pace.

What does this mean for your move? If you buy now, your home is likely to increase in value, allowing you to build equity in the coming years. However, based on these forecasts, if you wait and prices continue to climb, the cost of purchasing a home will be higher later on.

2. When Will Mortgage Rates Come Down?

This is the million-dollar question in the industry, and there's no easy way to answer it. The volatile mortgage rate environment is influenced by numerous factors. Odeta Kushi, Deputy Chief Economist at First American, explains:

“Every month brings a new set of inflation and labor data that can influence the direction of mortgage rates. Ongoing inflation deceleration, a slowing economy and even geopolitical uncertainty can contribute to lower mortgage rates. On the other hand, data that signals upside risk to inflation may result in higher rates.”

What happens next will depend on where each of those factors goes from here. Experts are optimistic rates should still come down later this year, but acknowledge changing economic indicators will continue to have an impact. As a CNET article says:

“Though mortgage rates could still go down later in the year, housing market predictions change regularly in response to economic data, geopolitical events and more.”

If you're ready, willing, and able to afford a home right now, it's wise to partner with a trusted real estate advisor. They can help you weigh your options and decide what's best for you.

Bottom Line

Let's connect to ensure you have the latest information on home prices and mortgage rate expectations. Together, we can review what the experts are saying, so you can make an informed decision about your move.

Categories

Recent Posts

GET MORE INFORMATION