What an Economic Slowdown Could Mean for the Housing Market

What an Economic Slowdown Could Mean for the Housing Market

Economic uncertainty and talks of a possible recession are making headlines again, and naturally, many homeowners and buyers are asking how that could impact housing. A look at past recessions helps bring some clarity.

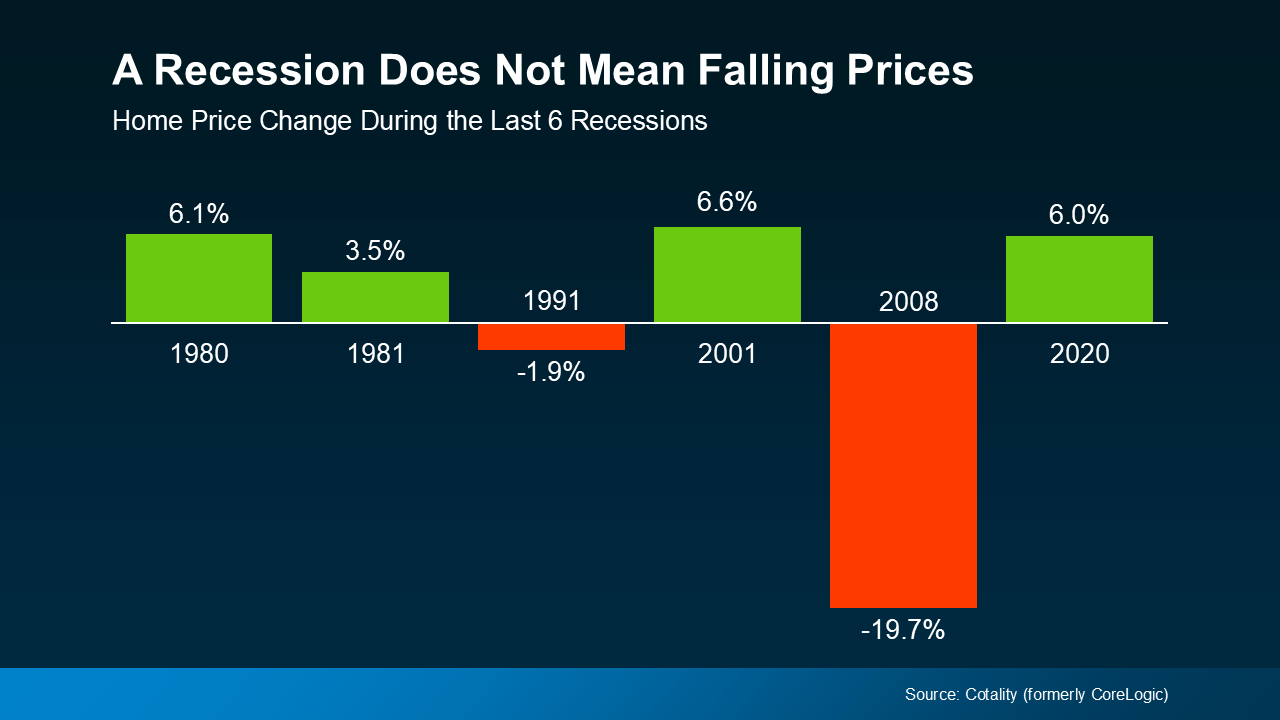

A Recession Doesn’t Always Equal Falling Home Prices

The common belief is that a recession automatically means home prices will drop—but that’s not typically the case. While the 2008 housing crash led to a major price decline, that event was driven by a very specific set of circumstances: widespread risky lending, a flood of foreclosures, and a massive oversupply of homes.

Today’s market is very different. Even in places where inventory has started to grow, we’re still well below the levels that triggered the crash. Low supply continues to be a key factor supporting home values.

In fact, historical data from Cotality (formerly CoreLogic) shows that in four of the last six recessions, home prices actually went up—not down. This trend suggests that while a recession may cool the pace of appreciation, it doesn’t necessarily mean prices will fall.

Understanding this can help ease concerns and guide better decisions in today’s market. (see graph below)

So, don’t assume a recession will lead to a significant drop in home values. The historical data doesn’t support that idea. Typically, home prices continue on the path they were already following—and right now, on a national level, they’re still climbing, just at a more moderate and sustainable pace.

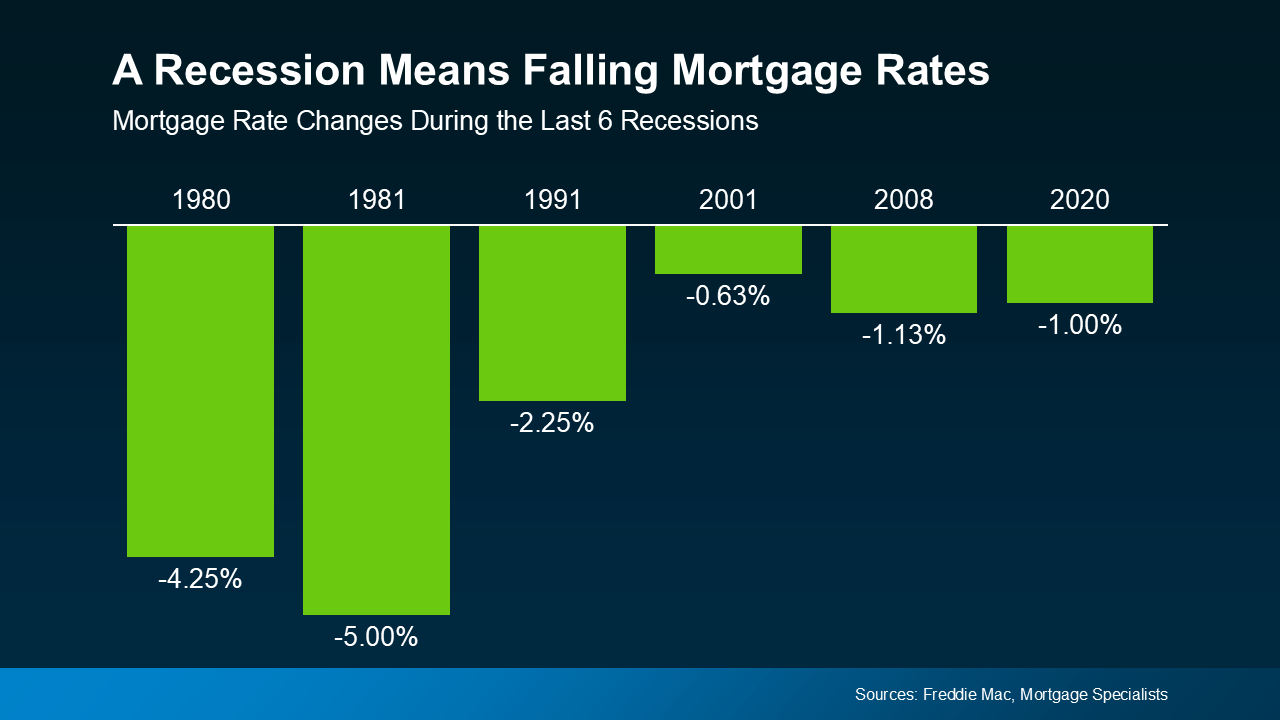

Mortgage Rates Usually Dip During Recessions

While home prices tend to stay steady or grow, mortgage rates often respond differently. History shows that during economic slowdowns, mortgage rates generally decline. Looking at the last six recessions, rates dropped every single time. This trend can actually boost affordability and open up better opportunities for buyers.

So even if a recession does happen, it could end up creating more favorable conditions for those looking to purchase a home.

So, a recession could mean lower mortgage rates, which would improve your buying power—but it’s important not to expect rates to drop back down to the 3% range we saw a few years ago.

Bottom Line

While it’s still uncertain whether a recession will happen, the chances have increased. But that doesn’t mean you need to worry about falling home values or a repeat of the past. Historical trends show that the housing market tends to remain steady, even during economic slowdowns.

If you’re curious how today’s economy is affecting our local market, let’s connect and talk about what it means for your plans.

Categories

Recent Posts