What You Need To Know About Homeowner’s Insurance

What You Need To Know About Homeowner’s Insurance

Why Homeowner’s Insurance Costs Are Rising

Homeowner’s insurance is essential to protect your home and personal belongings from unexpected events like fire, storms, and theft. It also provides liability coverage if someone is injured on your property. But insurance costs have been increasing in recent years due to several key factors:

- More Severe Weather Events: Hurricanes, wildfires, and storms are happening more frequently, leading to higher claims.

- Reduced Options in High-Risk Areas: Some insurers are pulling out of areas prone to disasters, reducing choices for homeowners.

- Underpriced Past Rates: Previous rate increases haven't kept pace with rising claims costs.

- Higher Rebuilding and Repair Costs: Material and labor costs have gone up, making repairs and rebuilding more expensive.

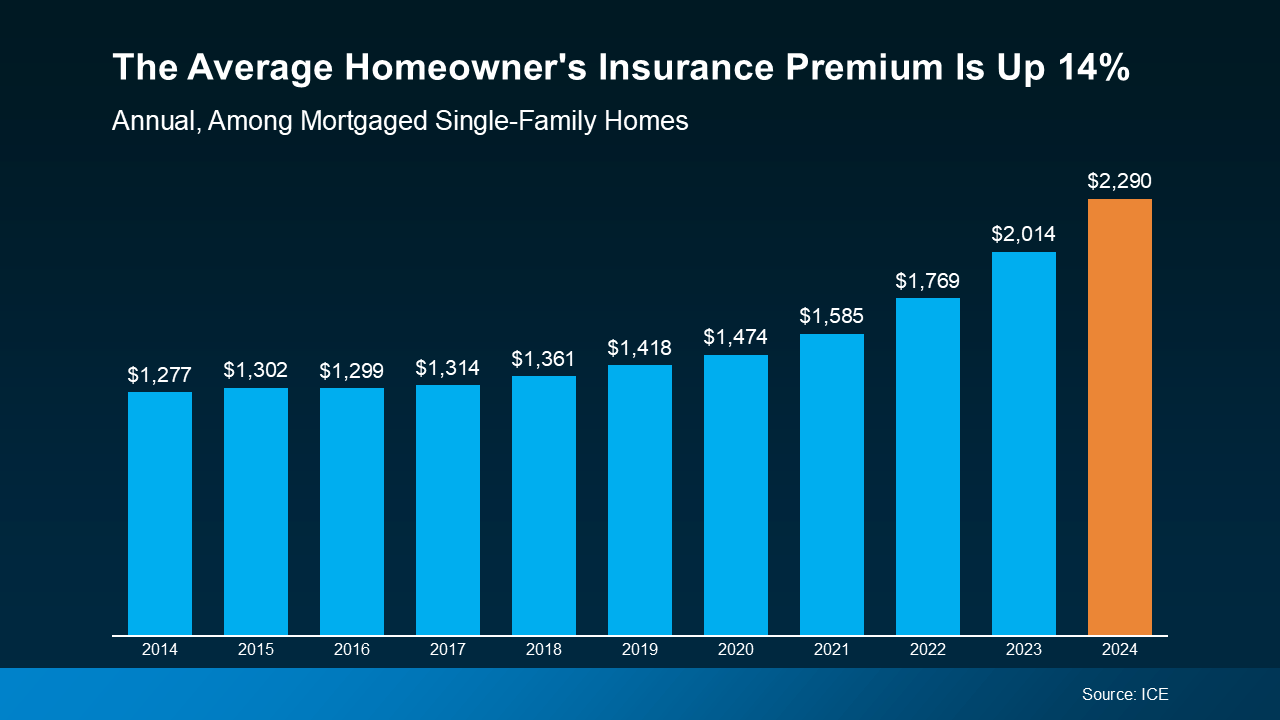

As a result, average yearly premiums have climbed steadily over the past decade, reflecting the growing challenges in the insurance market.

What This Means for You

While your first insurance payment is typically included in your closing costs, homeowner’s insurance is a recurring expense that you'll need to budget for after closing day. Working with a trusted insurance provider can help you find the right balance of coverage and cost to protect your investment.

How To Manage Rising Homeowner’s Insurance Costs

Homeowner’s insurance is essential for protecting your home and investment, but rising costs mean it’s important to shop wisely. Here’s how you can find the right balance of coverage and cost:

- Compare Quotes: Rates vary by location, provider, and coverage. Get multiple quotes to find the best deal.

- Ask About Discounts: You may qualify for savings by installing security systems or bundling your policy with auto insurance.

- Review Coverage Regularly: As your home value and market conditions change, adjust your policy to stay protected without overpaying.

Bottom Line

When budgeting for homeownership, factor in homeowner’s insurance alongside your mortgage payment. While costs are rising, taking the time to shop around and explore discounts can help you secure the best rate possible.

Categories

Recent Posts

GET MORE INFORMATION