What Homebuyers Need To Know About Credit Scores

What Homebuyers Need To Know About Credit Scores

Data reveals that 7 out of 10 prospective homebuyers are unaware of the minimum credit score lenders require or that it varies depending on the lender and loan type. Experian notes that minimum credit scores range from 500 to 700. This means you don’t need a perfect credit score to purchase a home. While your credit score matters, perfection isn’t necessary.

Consult with a lender to explore home loan options that could suit your situation.

Categories

Recent Posts

Your House Didn’t Sell. Here’s What To Do Now.

Is Inventory Getting Back To Normal?

The Five-Year Rule for Home Price Perspective

Buying Your First Home? FHA Loans Can Help

The Big Difference Between a Homeowner’s and a Renter’s Net Worth

The Rooms That Matter Most When You Sell

Understanding Today’s Mortgage Rates: Is 3% Coming Back?

Why Buying Real Estate Is Still the Best Long-Term Investment

Newly Built Homes May Be Less Expensive Than You Think

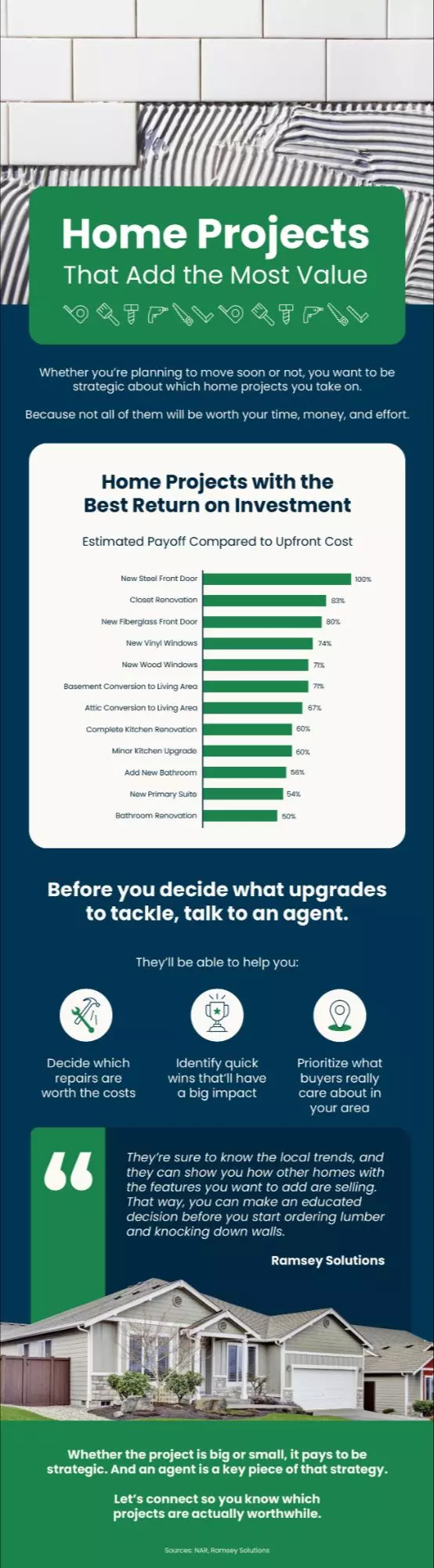

Home Projects That Add the Most Value