The 20% Down Payment Myth, Debunked

The 20% Down Payment Myth, Debunked

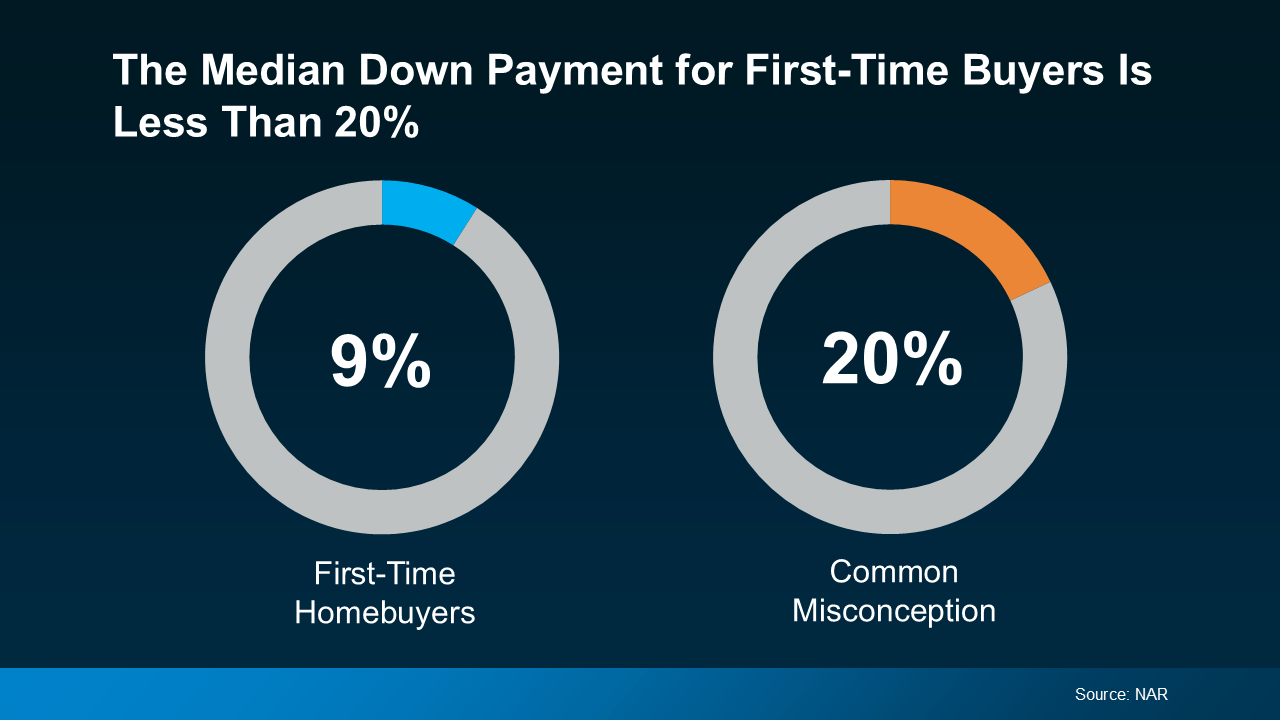

Buying a home can feel overwhelming, especially when it comes to saving up. One of the biggest hurdles for first-time buyers is the belief that a 20% down payment is required — but that’s not always the case.

This is actually one of the most common misunderstandings.

Is a 20% Down Payment Necessary To Buy a Home?

Unless it’s specifically required by your loan or lender, chances are you won’t need to put 20% down. There are plenty of loan programs designed to help first-time buyers purchase a home with a much smaller upfront payment.

FHA loans, for instance, allow down payments as low as 3.5%. VA and USDA loans even offer options with no down payment at all for those who qualify, such as Veterans. So, while putting more down can be beneficial, it’s not a requirement. As The Mortgage Reports says:

“. . . many homebuyers are able to secure a home with as little as 3% or even no down payment at all . . . the 20 percent down rule is really a myth.”

The National Association of Realtors (NAR) notes that first-time buyers typically put down much less — with the median at just 9%.

Here’s what you should know: you may not need to save as much as you once thought.

Even better, there are many programs available that can help supplement your down payment savings — and chances are, you might not even realize they exist.

Why Explore Down Payment Assistance Programs?

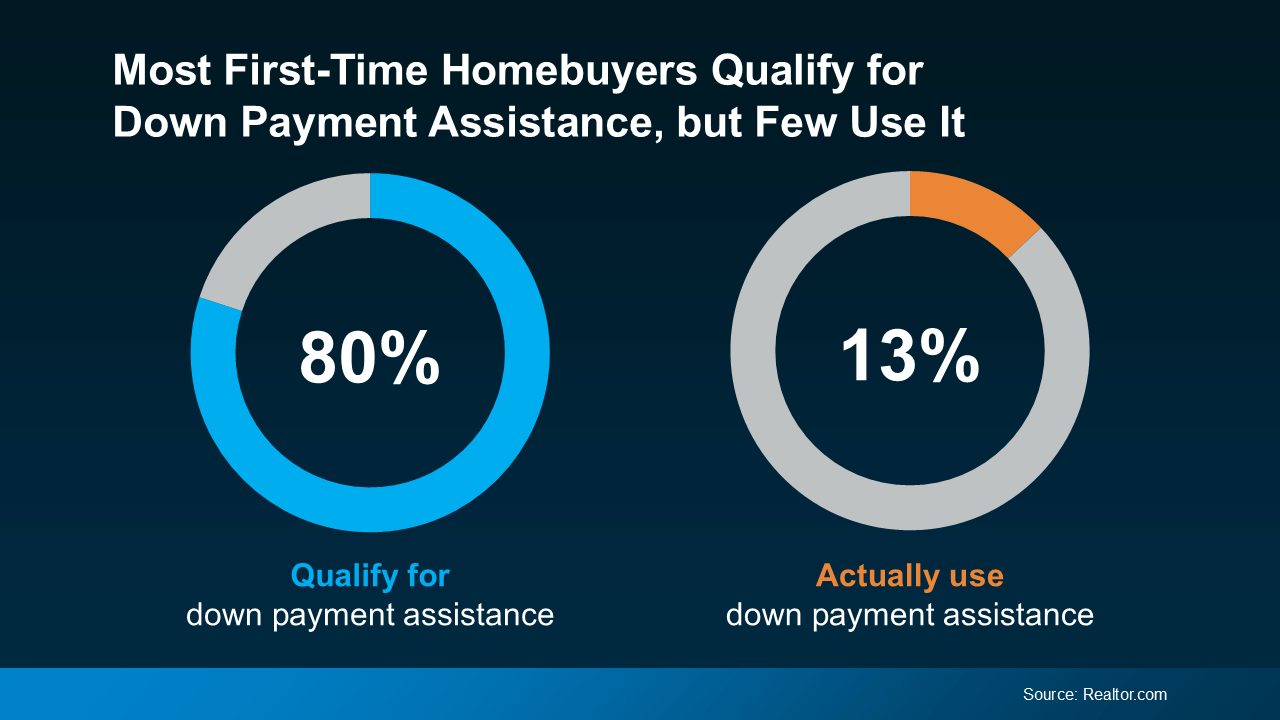

Surprisingly, nearly 80% of first-time buyers are eligible for down payment assistance (DPA), yet only 13% take advantage of it (see chart below):

That’s a huge opportunity many buyers are missing out on. These programs aren’t just small perks—they can provide thousands of dollars to help with your down payment. As Rob Chrane, Founder and CEO of Down Payment Resource, puts it:

“Our data shows the average DPA benefit is roughly $17,000. That can be a nice jump-start for saving for a down payment and other costs of homeownership.”

Now imagine how much further your savings could stretch with an extra $17,000 in assistance. In some cases, it’s even possible to combine multiple programs, giving your savings an even bigger boost. These are the kinds of advantages you don’t want to overlook.

Bottom Line

Saving for your first home can feel overwhelming—especially if you still believe the 20% down payment myth. In reality, many loans require far less, and there are great programs that can help strengthen your savings.

If you’re curious about what options are out there and whether you might qualify for down payment assistance, reach out to a trusted lender to explore your possibilities.

Categories

Recent Posts