Now’s the Time To Upgrade to Your Dream Home

Now’s the Time To Upgrade to Your Dream Home

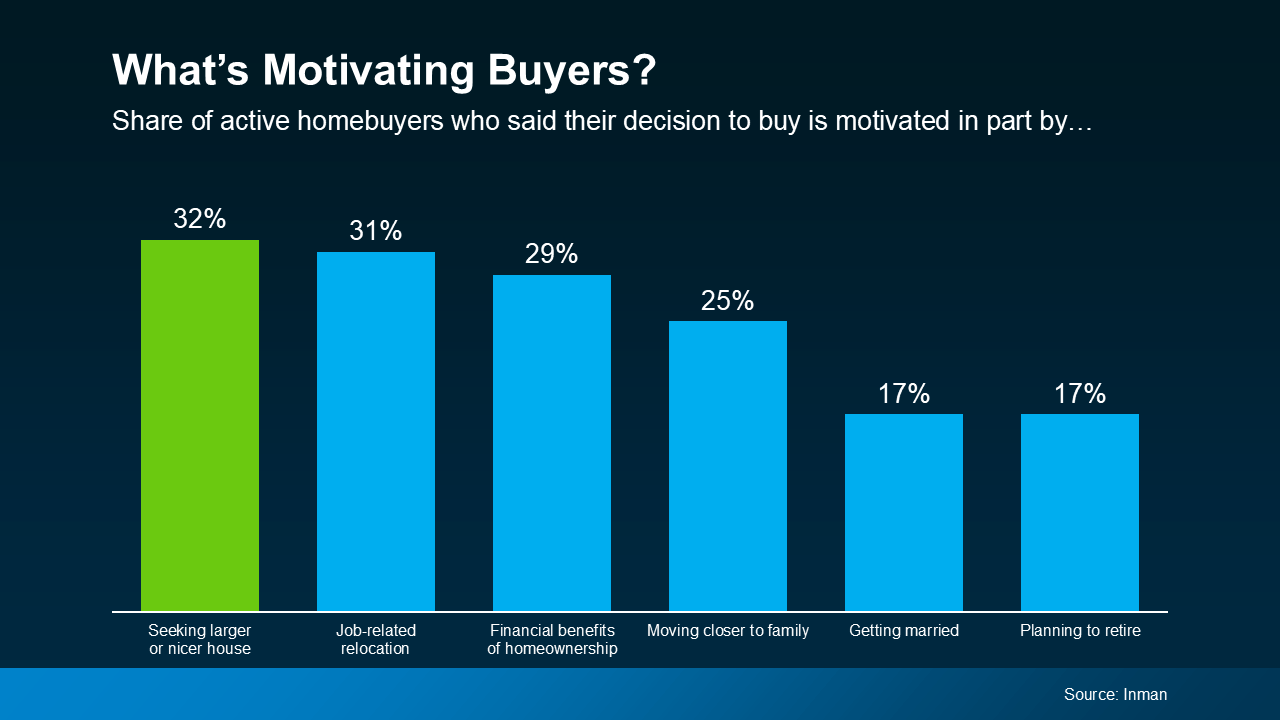

If you're thinking about selling your home and upgrading to a bigger or nicer one, you're not the only one. According to a recent Inman survey, the top reason today's homebuyers are entering the market is their desire for more space or a better home. The data shows that many buyers share the same goal of finding a place that fits their growing needs.

Many people, like yourself, may have been postponing their plans due to recent market challenges. It's completely understandable—affordability plays a major role when considering an upgrade that could raise your monthly housing expenses. However, there's some good news: right now is actually a great time to take the plunge. Here's why.

Many people, like yourself, may have been postponing their plans due to recent market challenges. It's completely understandable—affordability plays a major role when considering an upgrade that could raise your monthly housing expenses. However, there's some good news: right now is actually a great time to take the plunge. Here's why.

You Have a Lot of Equity To Leverage

One of the major advantages in today’s market is the substantial equity you’ve likely accumulated in your current home over time. Despite recent fluctuations in the housing market, home prices nationwide have continued to rise, contributing to the equity many homeowners now enjoy. As Selma Hepp, Chief Economist at CoreLogic, puts it:

“Persistent home price growth has continued to fuel home equity gains for existing homeowners who now average about $315,000 in equity and almost $129,000 more than at the onset of the pandemic.”

So, what does this mean for you? If you've been in your home for a few years, chances are you’ve built up a substantial amount of equity. This can be used as a down payment on your next home, which can help keep your loan amount manageable and within your budget.

This makes upgrading more attainable than you might expect. If you’re interested in finding out how much equity you’ve gained, reach out to your real estate agent for a professional equity assessment.

Mortgage Rates Have Fallen, Boosting Your Purchasing Power

Another compelling reason to make your move now is that mortgage rates are trending downward. Lower rates can reduce your future monthly payments, making them more affordable, while also boosting your purchasing power. As Nadia Evangelou, Senior Economist and Director of Real Estate Research at the National Association of Realtors (NAR), highlights:

“When mortgage rates fall, the interest portion of monthly payments decreases, which lowers the total payment. This makes it easier for more borrowers to . . . qualify for mortgages that may have been unaffordable at higher rates.”

This increased purchasing power gives you more flexibility when browsing for homes and may even allow you to afford a property that was previously beyond your budget. A trusted lender can help you develop a personalized plan that fits your financial goals.

Bottom Line

If you're ready to sell your current home and upgrade to the larger, more luxurious home you've been dreaming of, now is the time to act. With the combination of your built-up equity and lower mortgage rates, you're in an excellent position to make that move today.

To ensure you maximize your current market advantage and make informed decisions, let's connect. Having an expert guide you through every step of the homebuying process can make all the difference.

Categories

Recent Posts