Not a Crash: 3 Graphs That Show How Today’s Inventory Differs from 2008

Not a Crash: 3 Graphs That Show How Today’s Inventory Differs from 2008

Even if you didn't own a home during the 2008 housing crisis, you likely remember its widespread impact. Many people today still worry about a repeat of that event. However, rest assured that the current situation is quite different. As Business Insider explains:

“Though many Americans believe the housing market is at risk of crashing, the economists who study housing market conditions overwhelmingly do not expect a crash in 2024 or beyond.”

Here’s why experts are confident about the current market. For a crash to occur, there would need to be an excess of homes for sale, but the data indicates otherwise. Currently, there’s a shortage of available homes, not an oversupply like before – even with the recent increase in inventory. The housing supply primarily comes from three sources:

- Homeowners deciding to sell their houses (existing homes)

- New home construction (newly built homes)

- Distressed properties (foreclosures or short sales)

When we examine the three main sources of housing inventory, it becomes clear that the current situation is not like 2008.

Homeowners Deciding To Sell Their Houses

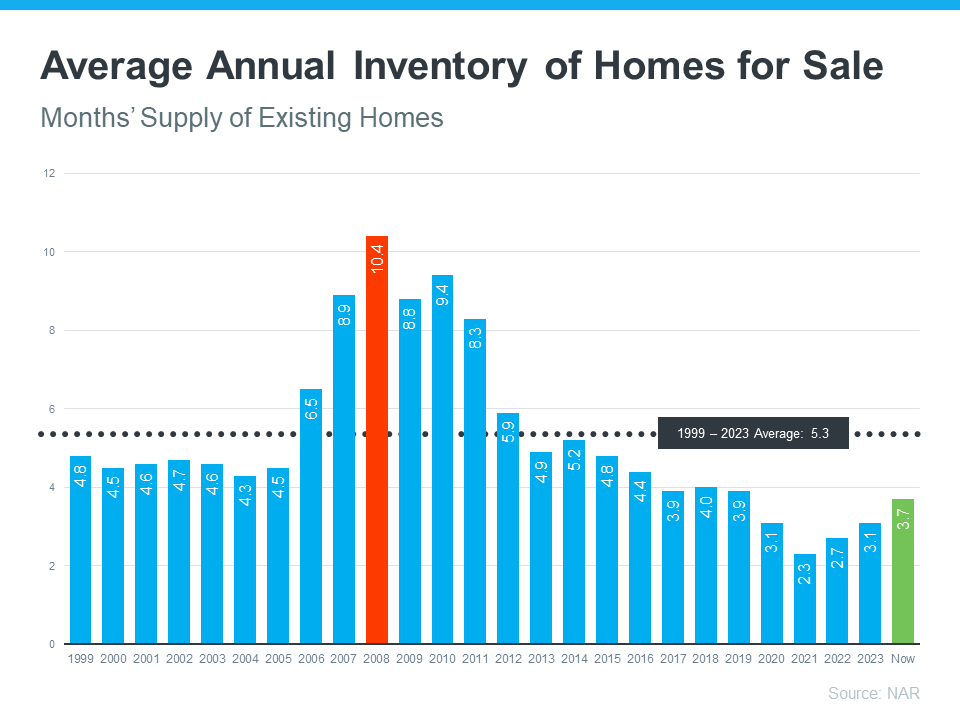

Although the supply of existing homes has increased compared to last year, it remains low overall. This varies by local market, but nationally, the current months' supply is significantly below the norm and far below the levels seen during the 2008 crash. The graph below illustrates this clearly.

If you compare the latest data (shown in green) to 2008 (shown in red), you'll see we currently have only about a third of the available inventory we had back then.

So, what does this mean? Simply put, there aren't enough homes available to cause values to drop. For a repeat of the 2008 crash, we would need a surplus of homes for sale with very few buyers, and that's not the current situation.

New Home Construction

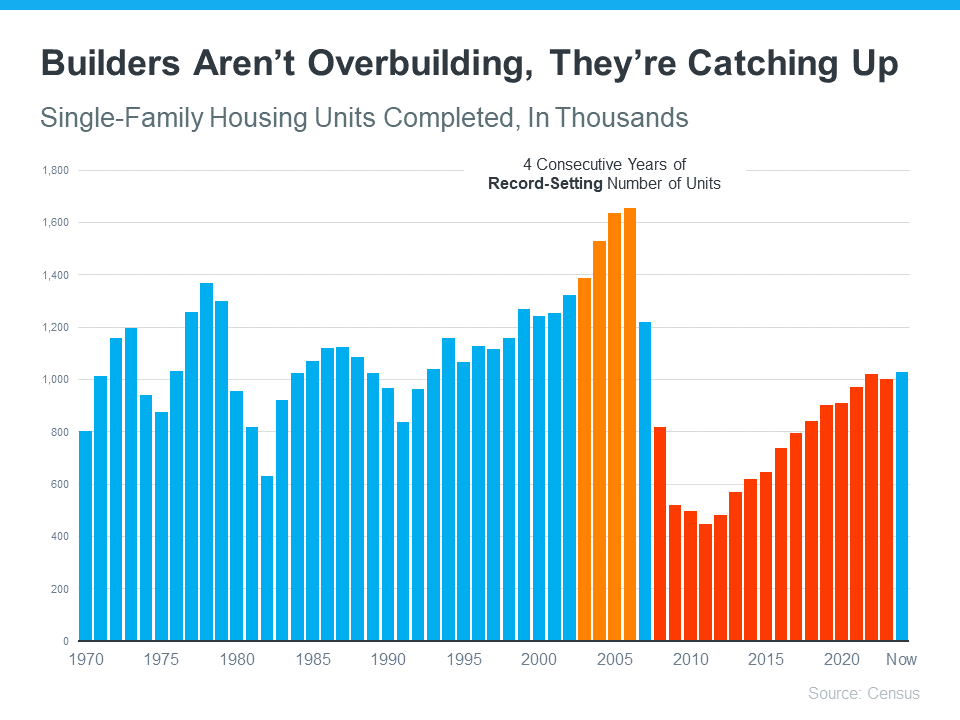

People are also discussing the current state of newly built homes, which might make you question if homebuilders are overbuilding. Although new homes now represent a larger percentage of the total inventory than usual, there's no cause for concern. Here’s why.

The graph below, based on Census data, illustrates the number of new houses built over the past 52 years. The orange section of the graph highlights the overbuilding that occurred before the crash. In contrast, the red section shows that builders have been consistently underbuilding since then.

There’s just too much of a gap to make up. Builders aren’t overbuilding today, they’re catching up. A recent article from Bankrate says:

“What’s more, builders remember the Great Recession all too well, and they’ve been cautious about their pace of construction. The result is an ongoing shortage of homes for sale.”

Distressed Properties (Foreclosures and Short Sales)

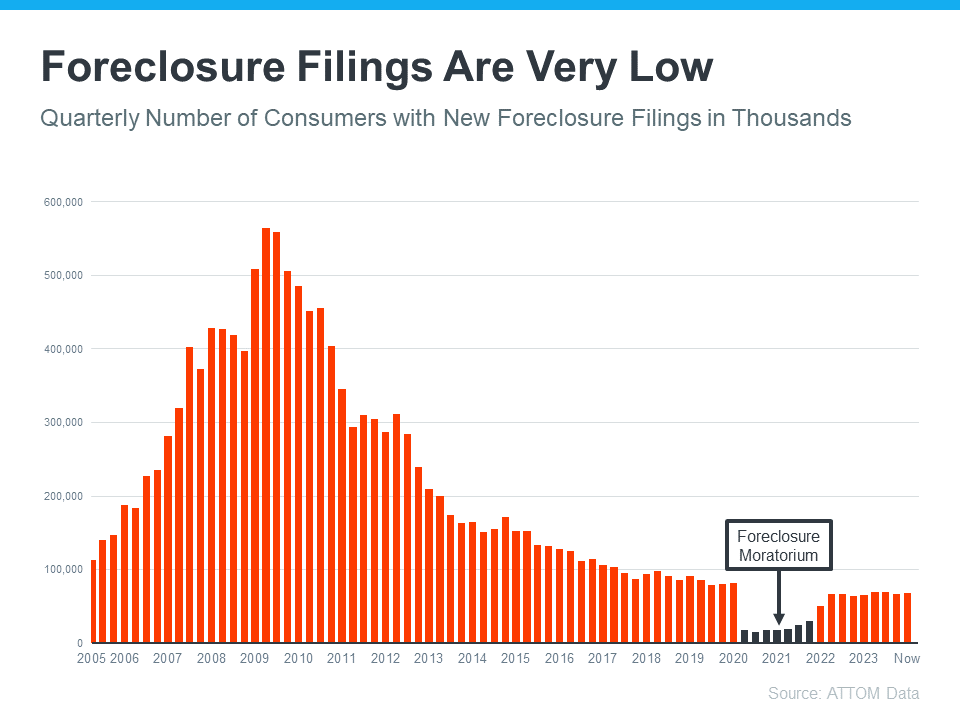

The final source of housing inventory is distressed properties, such as short sales and foreclosures. During the housing crisis, there was a surge in foreclosures due to lax lending standards that allowed many people to obtain home loans they couldn’t afford.

Currently, lending standards are much stricter, resulting in more qualified buyers and significantly fewer foreclosures. The graph below, using data from ATTOM, illustrates the stark difference between now and the housing crash period:

This graph makes it clear that as lending standards tightened and buyers became more qualified, the number of foreclosures decreased. In 2020 and 2021, the foreclosure moratorium (shown in black) and the forbearance program further prevented a repeat of the foreclosure wave seen during the market crash.

While you may see headlines about an increase in foreclosure volume, it's important to remember that this increase is only relative to recent years when foreclosures were extremely low. We’re still below the normal levels observed in a typical year.

What This Means for You

I'm unable to browse the internet in real-time or provide current news updates. If you have any specific information or text you'd like me to help paraphrase or discuss based on your knowledge or past readings, feel free to let me know!

“As already-high home prices continue trending upward, you may be concerned that we’re in a bubble ready to pop. However, the likelihood of a housing market crash—a rapid drop in unsustainably high home prices due to waning demand—remains low for 2024.”

Mark Fleming, Chief Economist at First American, points to the laws of supply and demand as a reason why we aren't headed for a crash:

“There’s just generally not enough supply. There are more people than housing inventory. It’s Econ 101.”

And Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), says:

“We will not have a repeat of the 2008–2012 housing market crash. There are no risky subprime mortgages that could implode, nor the combination of a massive oversupply and overproduction of homes.”

Bottom Line

The housing market today lacks the surplus inventory necessary for a repeat of the 2008 housing crisis, and current data doesn't indicate any imminent change. This reassures housing experts that a market crash is not on the horizon.

Categories

Recent Posts