More Homes for Sale Isn’t a Warning Sign – It's Your Buying Opportunity

More Homes for Sale Isn’t a Warning Sign – It's Your Buying Opportunity

You may have heard that the number of homes on the market is higher than it’s been in recent years, leading some to wonder if this signals another housing market crash.

However, the truth is the data shows otherwise. In many regions, a rise in inventory is actually a positive sign that the market is stabilizing and becoming healthier.

What’s the Story with Inventory?

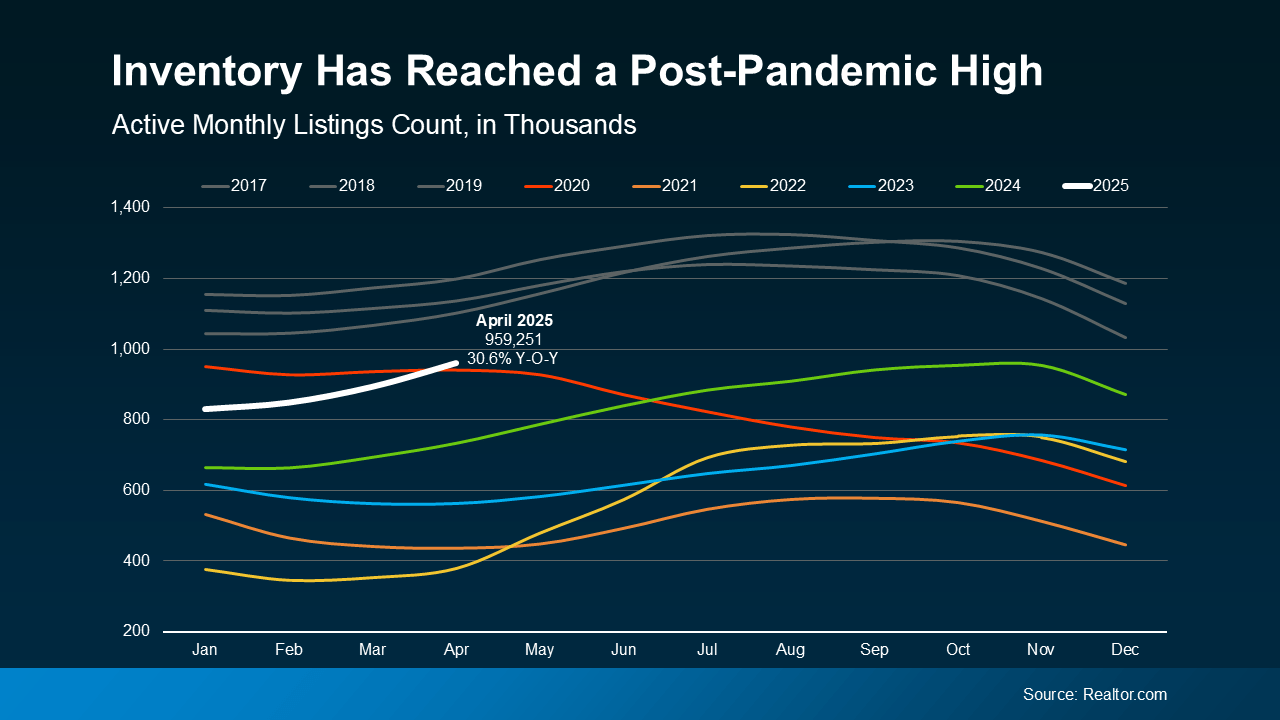

According to the latest numbers from Realtor.com, the current inventory has climbed to its highest level since 2020, illustrated by the white line in the graph below.

Still, it’s important to note that inventory hasn’t fully returned to the typical levels seen before the pandemic (shown in gray):

That means there are currently more homes on the market than we’ve seen in quite a while.

And while it’s true that inventory has grown compared to recent years, it’s still far below the usual levels we’d expect. That context is key.

Why This Isn’t the Concern Many Assume It Is

When people hear that inventory is rising, they often think back to 2008 — when a flood of listings preceded the housing market crash. But what’s happening today is quite different.

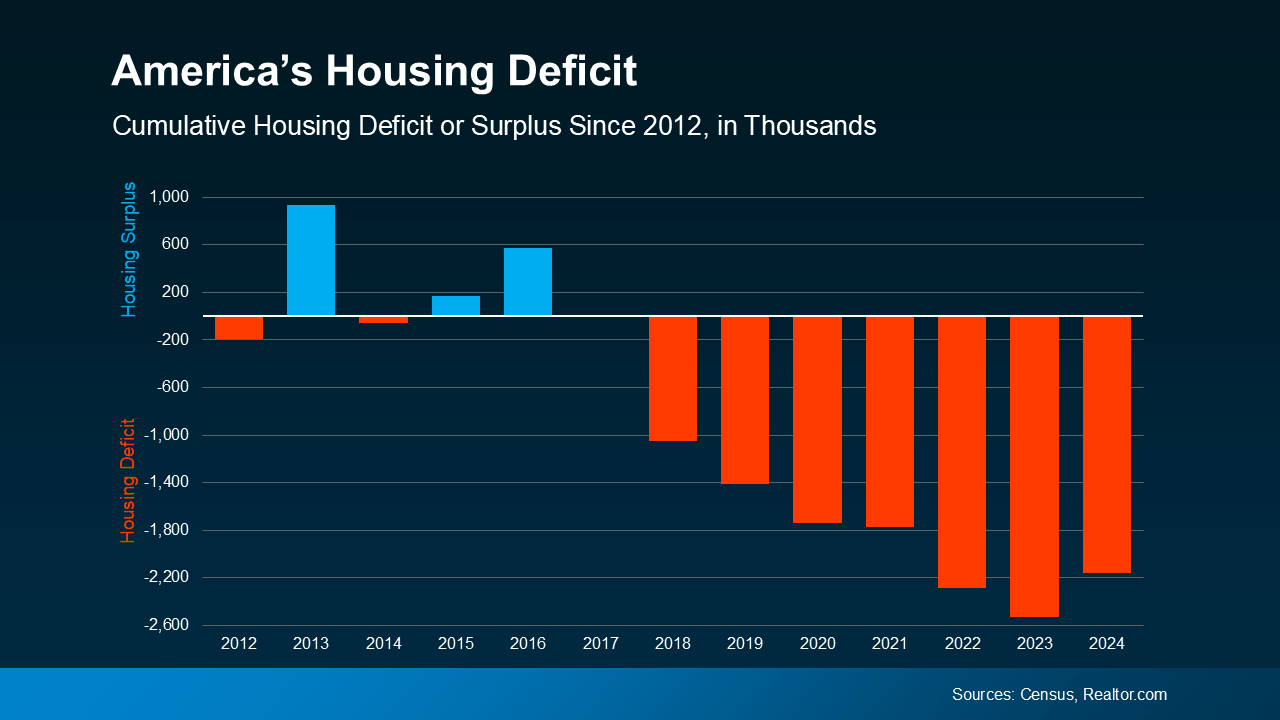

Here’s the main reason why: we’re not experiencing an oversupply of homes — we’re still facing a shortage. The current challenge stems from a long-term gap in housing supply.

The red bars in the graph below highlight all the years since 2012 when new home construction lagged behind household formation. The deeper the red, the larger the shortfall (see graph below):

One reason this ongoing housing shortage has continued is that the pace of new construction hasn’t matched the growing demand from people looking to buy. Currently, the U.S. is short by several million homes, and closing that gap will take time. According to Realtor.com:

“At a 2024 rate of construction relative to household formations and pent-up demand, it would take 7.5 years to close the housing gap.”

This means that in most areas, there’s no danger of an oversupply. In fact, many markets are still in need of more homes.

That’s why, even with inventory increasing, it’s not an issue nationwide. It’s actually helping address a long-standing shortage.

Bottom Line

Don’t be alarmed by the headlines. More homes for sale isn’t a sign of a crash — it’s a move toward a healthier, more balanced housing market.

Categories

Recent Posts