Many Veterans Don’t Know about This VA Home Loan Benefit

Many Veterans Don’t Know about This VA Home Loan Benefit

For the past 80 years, Veterans Affairs (VA) home loans have supported countless Veterans in purchasing homes. Yet, many eligible Veterans are still unaware of one of the program’s key advantages.

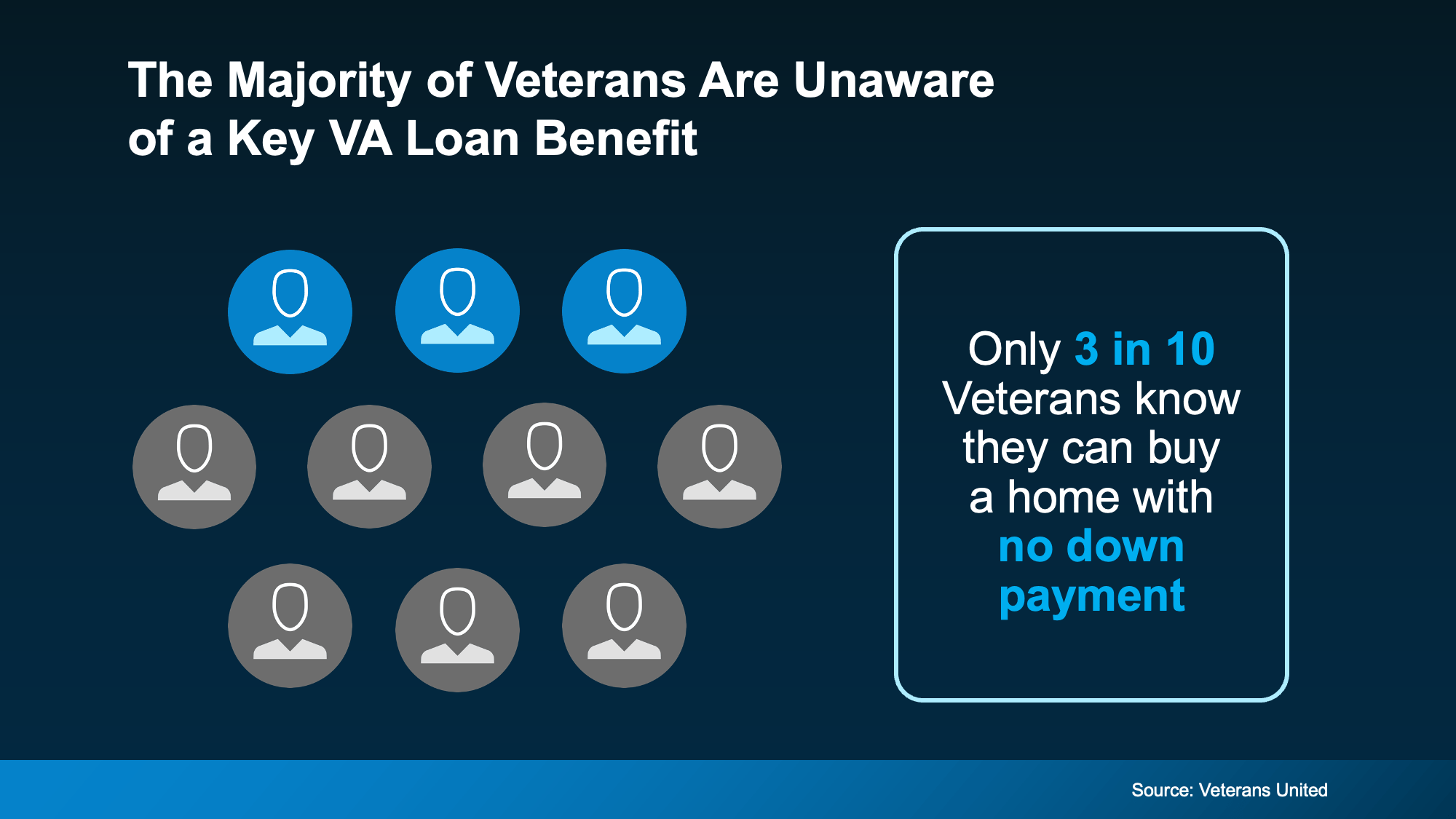

A report from Veterans United shows that only 3 in 10 Veterans know they may qualify to buy a home with no down payment through a VA loan (see visual below):

That means 7 out of 10 Veterans might be missing out on a major homebuying benefit.

That’s why spreading awareness is so important. Veterans United explains VA home loans:

“. . . come with a list of big-time benefits, including $0 down payment, no mortgage insurance, flexible and forgiving credit guidelines and the industry's lowest average fixed interest rates.”

The Benefits of VA Home Loans

VA loans are designed to make homeownership more accessible for those who’ve served—and by doing so, they also support their families in building equity and stability. According to the Department of Veterans Affairs, here are a few standout advantages:

-

No Down Payment Options: Many Veterans can purchase a home without putting any money down.

-

Capped Closing Costs: VA loans limit what Veterans are allowed to pay in closing costs, making the process more affordable.

-

No PMI Required: Unlike other loans, VA loans don’t require private mortgage insurance—even with no down payment. That saves you money every month.

If you’d like to learn more, the best place to start is with a trusted real estate professional and a knowledgeable lender.

Bottom Line

VA loans offer powerful benefits for those who qualify. If you’re a Veteran—or know someone who is—talk to a trusted lender today to see if you’re eligible and to explore your homeownership options.

Categories

Recent Posts