Is It Better To Rent or Buy a Home?

Is It Better To Rent or Buy a Home?

You might be wondering lately: is buying a home even worth it right now?

With elevated home prices and mortgage rates holding steady, renting can feel like the safer or only option. And that feeling is completely understandable. For some, now may not be the right time to buy — and that’s okay. Purchasing a home should only happen when it aligns with both your readiness and your circumstances.

But here’s something important to consider about renting.

While it might feel like a safer or even cheaper option from month to month, it can end up costing you more in the long run.

According to a recent survey from Bank of America, 70% of future homeowners are concerned about what renting long-term could mean for their financial future. And that concern is valid.

Even if homeownership seems out of reach today, creating a plan and working toward it can unlock major financial advantages over time.

Homeownership Builds Wealth Over Time

Owning a home isn’t just about having a place to call your own — it’s also a powerful way to build long-term wealth.

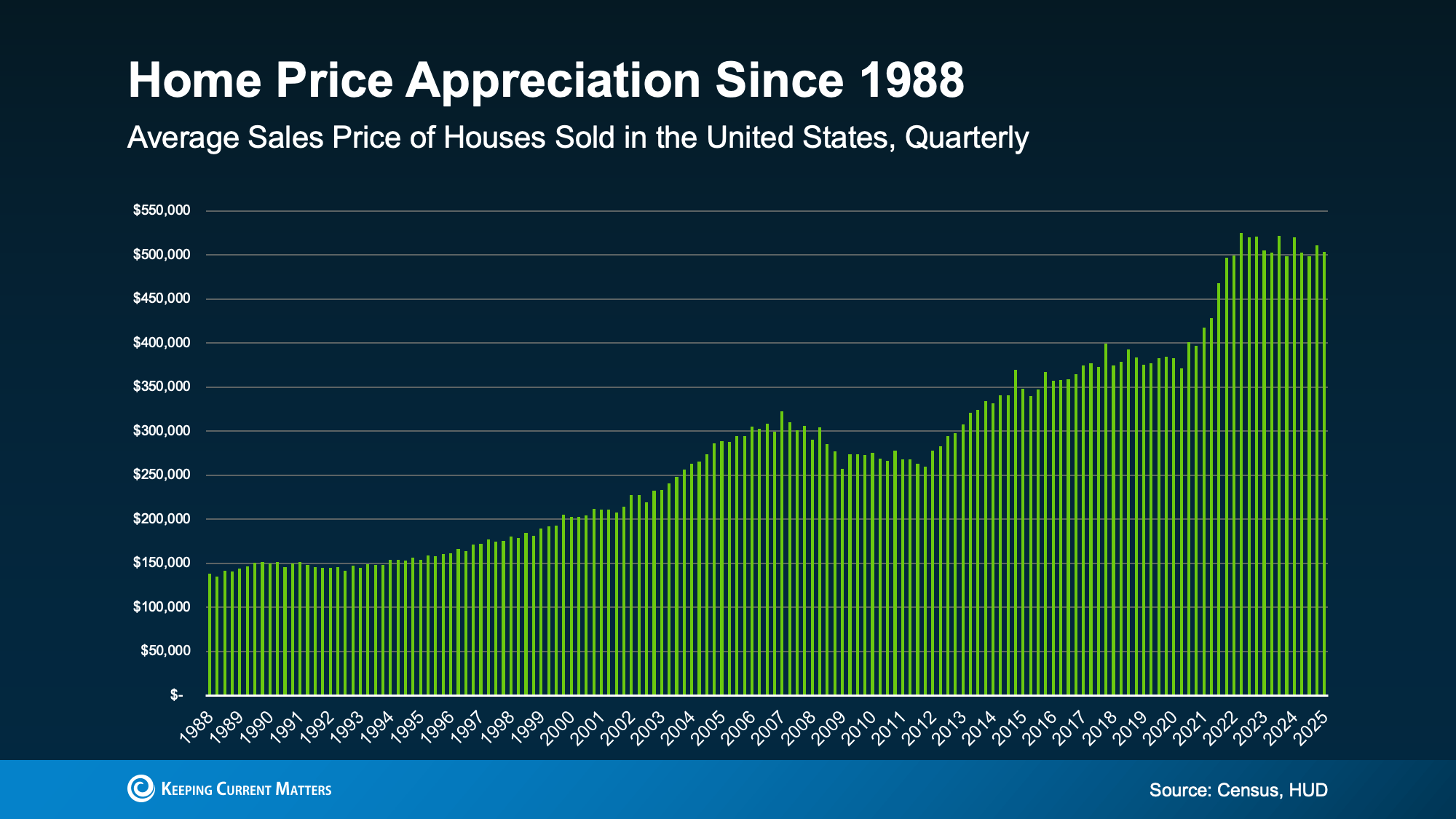

Here’s why: home values tend to rise with time. That means the longer you wait, the higher the cost to buy. Even in areas where prices are currently easing, the long-term trend remains clear (see graph below):

As home prices increase, so does your equity if you own a home. Equity is the gap between your home's current value and what you still owe on your mortgage. Each payment you make builds that equity — and over time, it contributes directly to your overall net worth.

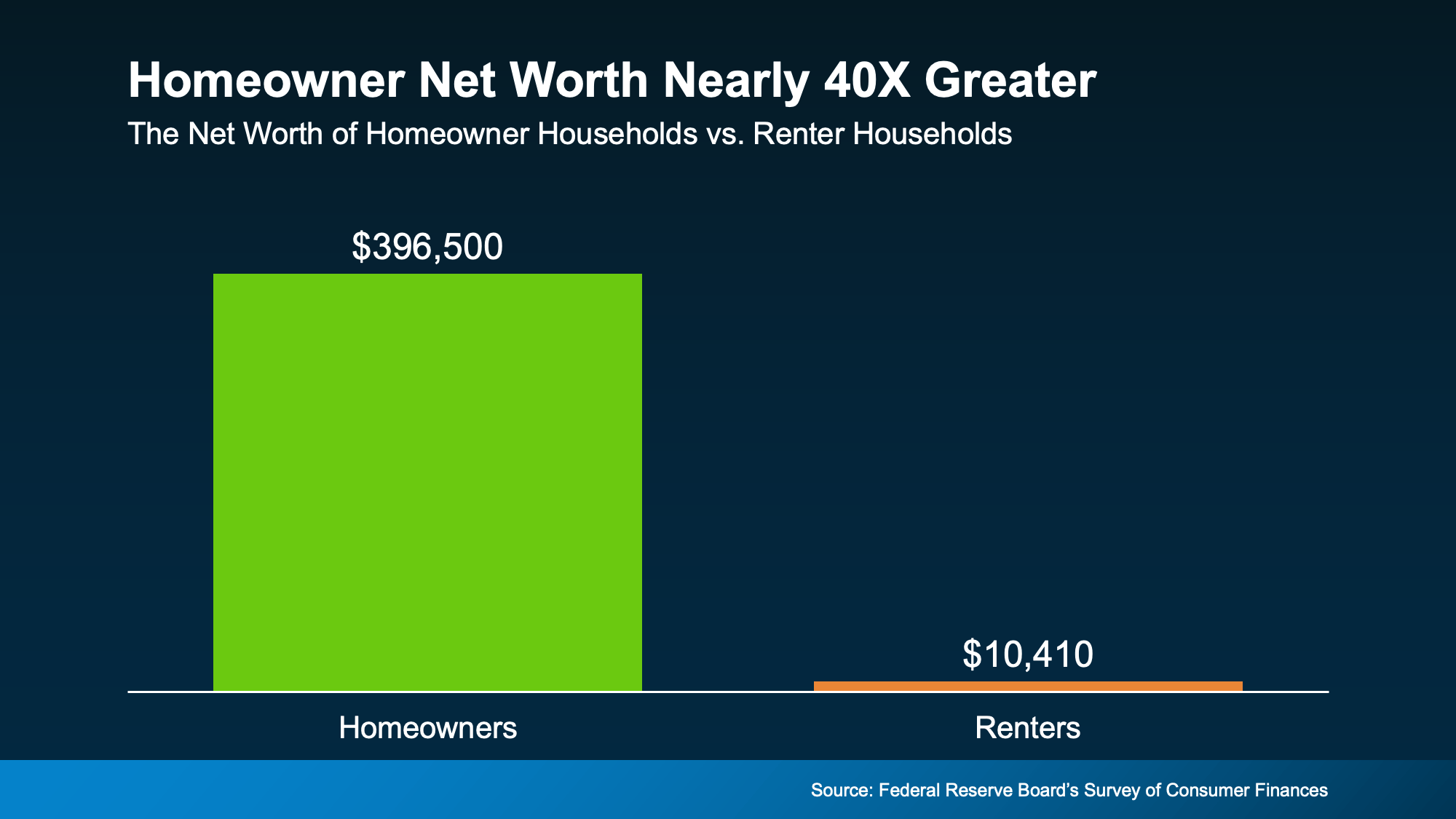

Right now, the average homeowner's net worth is almost 40 times higher than that of a renter. That’s a striking contrast, and the figures in the chart below clearly show just how significant that difference is (see graph below):

And that’s a major reason why Forbes notes:

“While renting might seem like [the] less stressful option . . . owning a home is still a cornerstone of the American dream and a proven strategy for building long-term wealth.”

The Biggest Downside of Renting

So why does renting often feel like the easier path in the short run? You might pay less each month, avoid maintenance duties, and enjoy the flexibility to move. But when you look ahead, the picture changes.

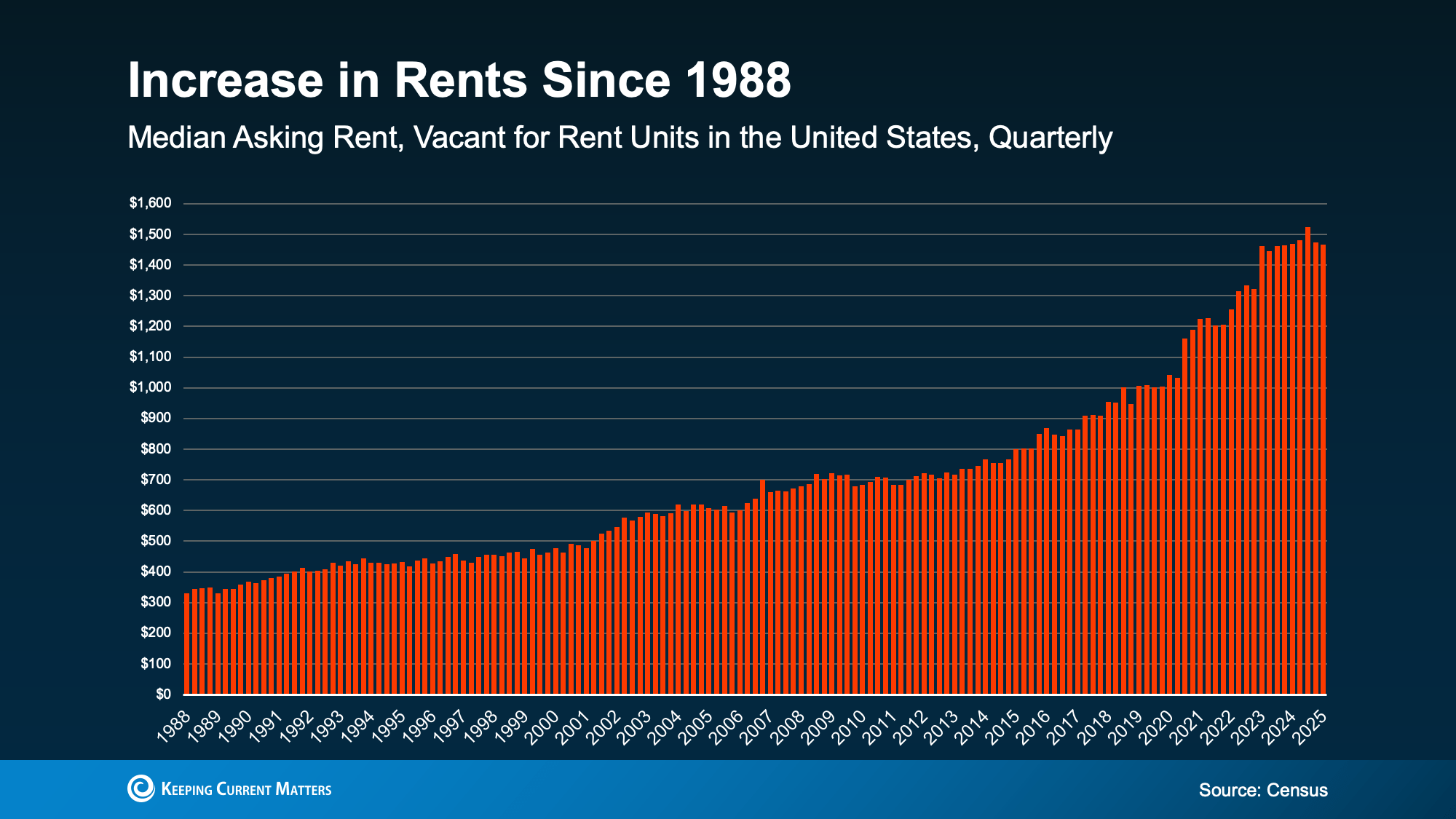

Over the years, both home values and rental costs have steadily climbed. Even though rent increases have slowed recently, the historical trend points upward. And that ongoing rise makes it even harder to set aside money for a future home (see graph below):

That kind of financial instability really does have consequences. According to the same Bank of America survey, 72% of future buyers are concerned that rising rents could negatively impact both their present and future financial stability.

That’s because rent doesn’t contribute to your wealth. It doesn’t generate a return. It goes toward your landlord’s mortgage – not your own.

So, whether you’re renting or owning, someone’s mortgage is getting paid. The question is: whose mortgage do you want to pay?

Renting vs. Buying: What Really Matters

Here’s how to look at it. When you rent, your money is spent and gone each month. When you own, your payments build equity – essentially growing a long-term financial asset you live in. Yes, homeownership brings responsibilities, but it also provides rewards that increase over time. That’s why planning ahead is key.

As Joel Berner, Senior Economist at Realtor.com, puts it:

“Households working on their budget will find it much easier to continue to rent than to go through the expenses of homeownership. However, they need to consider the equity and generational wealth they can build up by owning a home that they can’t by renting it. In the long run, buying a home may be a better investment even if the short-run costs seem prohibitive.”

Bottom Line

Renting might seem easier now. But over time, it often ends up costing more – and it doesn’t help build your future.

If buying feels out of reach today, you’re not alone. The first move to break the cycle of renting is creating a plan. Let’s talk, define your goals, and look at your options – so when the time is right, you’re ready.

Categories

Recent Posts