How To Buy a Home Without Waiting for Lower Rates

How To Buy a Home Without Waiting for Lower Rates

Many are waiting for mortgage rates to drop before buying a home. But will that happen? Experts predict rates will decline, though not as much as many hope.

The good news? Even if the drop is modest, there are still ways to make homebuying more affordable.

How Much Will Rates Drop?

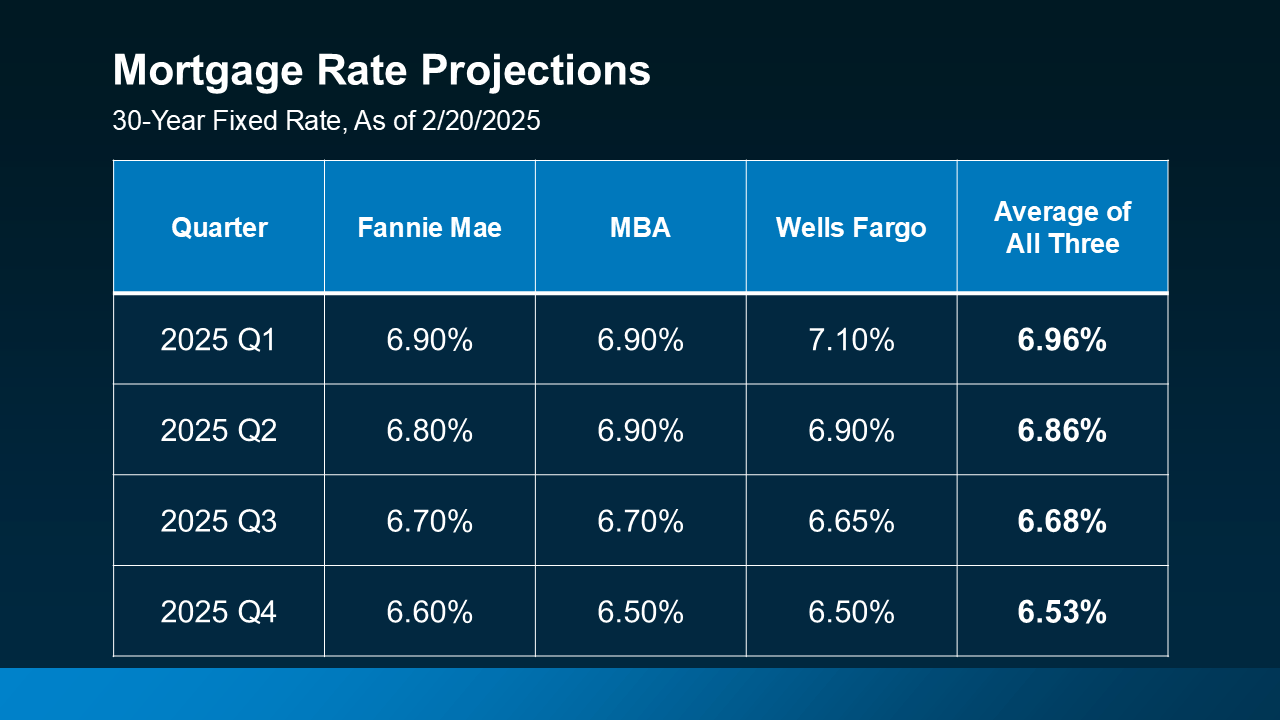

A few months ago, experts expected mortgage rates to fall below 6% by year-end. However, recent forecasts suggest that may not be the case.

While rates are still projected to decline, updated predictions from Fannie Mae, the Mortgage Bankers Association (MBA), and Wells Fargo now indicate they’ll likely stabilize around 6.5% to 7%.

If you’re waiting for significantly lower mortgage rates before buying a home, you might be holding off for longer than expected. And if a life change—like a new job, a growing family, or marriage—requires you to move, waiting may not be an option.

Creative Financing Options in Today’s Market

Since rates aren’t projected to drop as much as initially thought, exploring alternative financing strategies could help you buy sooner. Here are three options to discuss with your lender:

-

Mortgage Buydowns

A buydown lets you pay an upfront fee to lower your mortgage rate for a set period, reducing your early monthly payments. In fact, 27% of agents report first-time homebuyers are requesting seller-paid buydowns to make homeownership more affordable. -

Adjustable-Rate Mortgages (ARMs)

ARMs typically start with a lower interest rate than a 30-year fixed mortgage, making them appealing—especially if you expect rates to decline or plan to refinance later. Unlike the risky ARMs of the past, today’s versions come with more protections.

“. . . ARM products today are different from many of the products issued in the mid-2000s. Before 2008, lenders often approved ARMs based on borrowers ability to pay the initial lower interest rates. And sometimes they didn’t even check that (remember Ninja loans). Today, adjustable-rate borrowers qualify based on their ability to cover a higher monthly payment, not just the initial lower payment.”

In the past, banks approved loans without verifying if buyers could truly afford them. Today, lenders check income, assets, and employment, making ARMs much safer than before.

3. Assumable Mortgages

An assumable mortgage lets you take over the seller’s existing loan—along with their lower interest rate. With over 11 million homes qualifying for this option, according to U.S. News, it’s worth considering if you're looking for a more affordable rate.

Bottom Line

Waiting for mortgage rates to drop significantly might not be the best approach. Exploring options like buydowns, ARMs, or assumable mortgages could help make homeownership more affordable right now. Connect with a local lender to see what works for you.

How does this impact your homebuying plans this year?

Categories

Recent Posts

GET MORE INFORMATION